“Fun tax facts” may seem like an oxymoron, but sometimes taxes can be amusing. From a tax on beards in czarist Russia to an American astronaut who forgot to pay his taxes before heading into space, here are 51 unusual, funny, interesting — and sometimes practical — tax-related tidbits.

Related: Strange But True Tax Laws From All 50 States

Taxes Go Way Back

Governments have imposed taxes for thousands of years. There are recordings of tax payments made in ancient Mesopotamia circa 2500 B.C. At the time, people who didn’t have money to pay taxes often had to pay with livestock, food, or labor.

Related: 23 Tax Horror Stories That Will Make You Fear the IRS

We Tried a Flat Tax

America’s tax laws have been in flux for generations and remain so to this day. The first income tax in the United States came about with the Revenue Act of 1861. A flat 3% tax on income above $800 was used to fund the Civil War and repealed 11 years later. In 1894, a new flat federal income tax was ruled unconstitutional by the U.S. Supreme Court. It was not until the 16th Amendment was ratified in 1913 that the federal income tax finally stuck for good.

Tax Day Used to Be in March

Federal tax returns were not always due April 15. In 1913, March 1 was the big day; in 1918, it was moved to March 15; and finally in 1954 the current Tax Day was established.

For more fun trivia stories, please sign up for our free newsletters.

Withholding Started Because of a Cash Crunch

In the 1940s, the government needed a steady flow of cash to fund the war effort. It passed the Current Tax Payment Act of 1943, which required that companies withhold income taxes from employees’ paychecks and make ongoing payments on employees’ behalf. Before this (from 1916 to 1943), Americans paid income taxes quarterly or annually.

Few People Owed at First

Before World War II, few individuals or families owed income taxes. Due to a high personal exemption, only 1.1% of working-age people filed a return, according to the Tax Foundation, and about 17% of those filers did not have to pay income taxes.

Trending on Cheapism

Many People Pay No Tax Now

According to the Tax Policy Center think tank, 41.6% of tax filers will owe no individual income tax or have negative taxable income in 2024.

The Average Refund Is Worth About $3,200

As of Feb. 23, the average income tax refund was $3,213, according to the Internal Revenue Service. With over 44 million individual returns processed, the IRS has paid out nearly 29 million refunds.

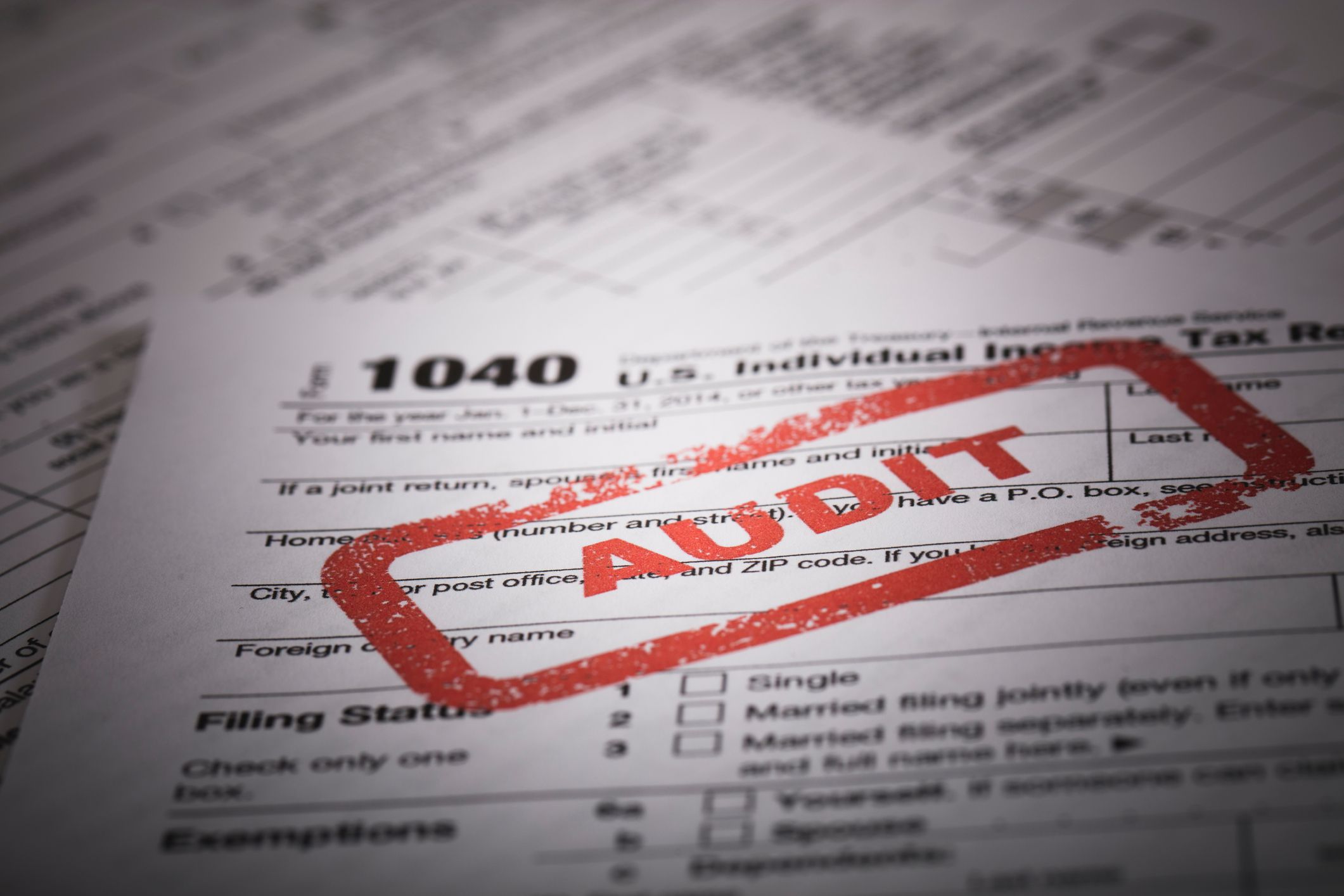

Related: How Your Tax Return Could Trigger an IRS Audit

1040EZ Is Gone

Because of the 2017 Tax Cuts and Jobs Act, the simple 1040EZ form is now gone, along with the 1040A and the standard 1040. They have all been replaced by a redesigned 1040 form and a 1040-SR for seniors.

Sign up for our newsletter

Even Einstein Didn’t Understand Taxes

Albert Einstein apparently found taxes more inscrutable than theoretical physics. He once said, “The hardest thing in the world to understand is the income tax” (that is, according Leo Mattersdorf, the math genius’ tax preparer).

Tax Prep Time Can Really Add Up

According to the IRS, the average time it used to take to complete a Form 1040 was 16 hours; a 1040A took seven hours; and a 1040EZ took five hours. This year, nonbusiness taxpayers can expect to spend some 9 hours on their taxes, while business taxpayers can look forward to spending an average of 24 hours.

There’s Only One Way Out

Aside from the nation of Eritrea, in Africa, the United States is the only country that requires citizens to pay taxes on their income if they work and live outside the country. Some wealthy individuals have renounced their citizenship and moved to another country to avoid paying taxes.

Related: How the Rich Hide Money From the IRS

There’s Another Tax Day on the Calendar

In 2023, Americans collectively had to work until April 18 — 108 days — to pay the country’s tax burden, according to information from the Tax Foundation, which declared that date Tax Freedom Day. On a state-by-state basis, New York residents had to work the longest, until May 3 in 2023. Residents of Alaska and Oklahoma had the earliest Tax Freedom Days, March 25 and March 30, respectively.

Americans’ Tax Bill Tops $5 Trillion

Collectively Americans paid $5.2 trillion in federal, state, and local taxes in 2019 — more than the combined cost of food, clothing, and housing, according to the Tax Foundation.

9 States Have No Income Tax

While there’s no dodging a federal bill, nine states don’t have an income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire taxes only investment income, and that tax is being phased out. Washington taxes capital gains over $250,000 at 7%.

States Make Residents Pay in Other Ways

States that don’t have an income tax get their revenue from other sources, such as sales or property taxes. In some cases, this actually places a higher tax burden on low- and middle-income families. They could wind up paying a larger portion of their income to the state than high-income families.

Taxpayers Get $13,850 in Tax-Free Earnings

Even though the personal exemption ($4,050) has been eliminated under the 2017 tax reform law, the standard deduction is $13,850 for tax year 2023, so single filers don’t pay federal tax on the first $13,850 they earned in 2023. For married taxpayers, the deduction is $27,700. For tax year 2024, these deductions will rise to $14,600 and $29,200.

There’s No Penalty for Reaching a Higher Bracket

Some people believe that moving into a higher tax bracket will net them less money in the end. But the United States uses marginal tax brackets, meaning the higher rate applies only to the earnings that fall within the higher bracket. If only a single dollar bumps a taxpayer into a higher bracket, only that one dollar is taxed at the marginal rate for that bracket.

Your Tax Bracket Isn’t the Rate You Actually Pay

To illustrate the difference between the marginal tax rate for people in a particular bracket vs. their effective tax rate — the average rate they actually pay — the Center on Budget and Policy Priorities once estimated the tax burden for a family of four with income of $110,000. Although the family fell into the 22% bracket, after accounting for standard deductions and credits and the progressive tax system in the United States, their effective income tax rate was only 6%.

Top 1% Pay a Huge Chunk of Income Tax Collected

According to the Tax Policy Center, the top 1% of earners in the United States paid 37.3% of all federal individual income tax in 2020. The top 0.1% paid 18% of the total.

Lottery Winners Take Home More in Some States

All winners of more than $5,000 in a lottery are subject to a 24% federal withholding tax, but state withholding taxes vary. In some states, such as California, Delaware, and Tennessee, the withholding rate is zero. In Maryland, the withholding rate is 8.75% for residents and 8% for non-residents. New York hits winners for 8.82%. And that’s just what the states take immediately; the winner may be required to pay additional taxes when filing a return.

The Highest Tax Bracket Has Been Much Higher

Today, the highest marginal income tax bracket is 37%, but it has been much higher. The Individual Income Tax Act of 1944 raised tax rates to the point where the highest bracket was 94%.

There Could Have Been a 100% Income Tax

A few months after the attack on Pearl Harbor, President Franklin D. Roosevelt proposed a 100% income tax. In a letter to Congress, he wrote that in this time of “grave national danger … no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year” (equivalent to about $525,000 today).

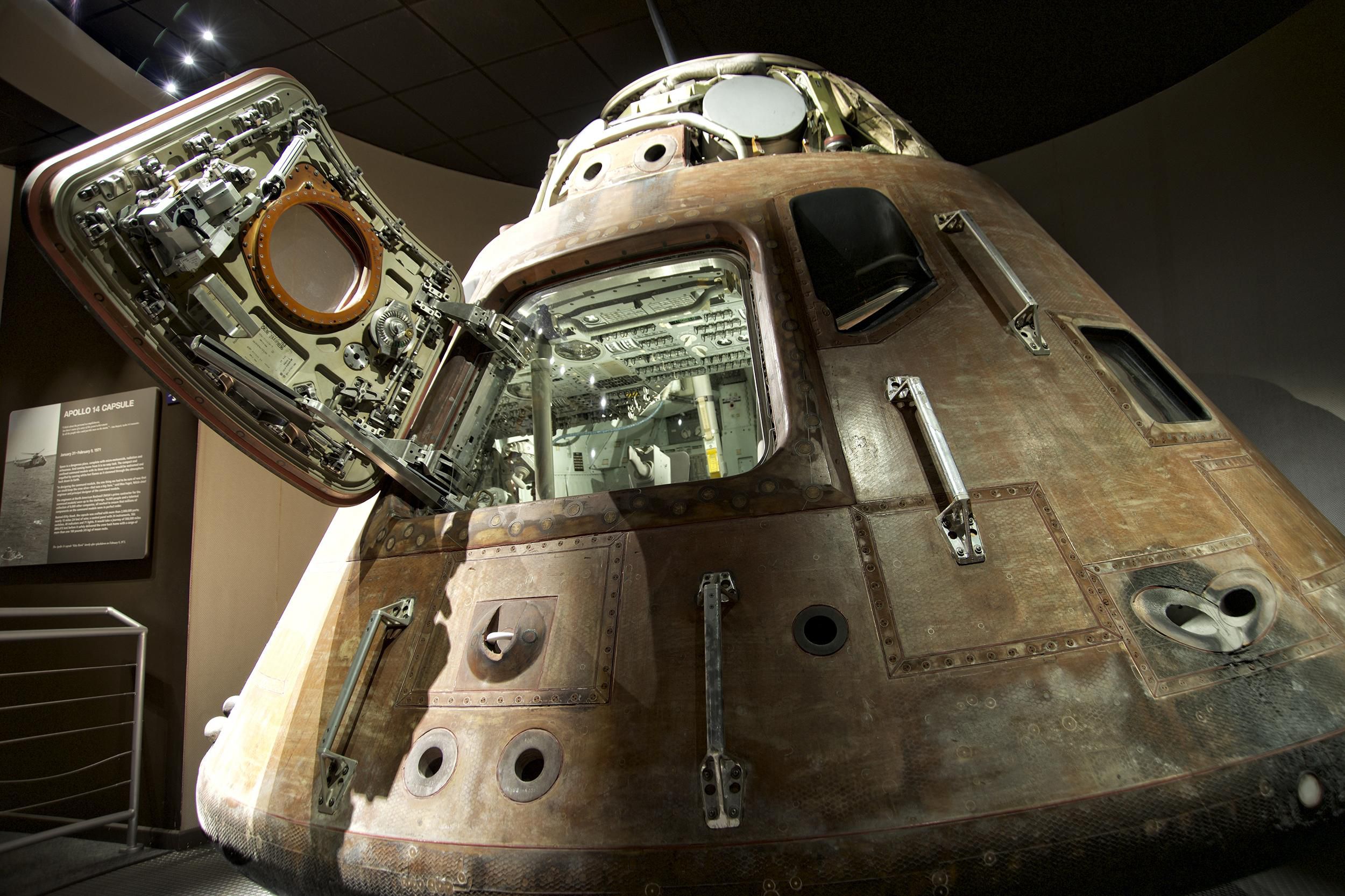

Houston, He Had a Problem

Astronaut Jack Swigert, the command module pilot for Apollo 13, got the assignment at the last minute because of health concerns surrounding another astronaut. In the rush, Swigert neglected to file his taxes. According to the transcript of the moment he realized his mistake, the crew on the ground thought he was joking, but Swigert was seriously asking how to file an extension.

Taxpayers Find Lots of Ways to Fool Themselves

While some people cite unintentional mishaps when the IRS audits them, others have made it a point not to pay taxes. Common arguments or tactics include claiming that the 16th Amendment was not properly ratified, that filing violates Fifth Amendment rights, or that the taxpayer has taken a religious vow of poverty. Others believe they can form a trust to hide taxable income. The IRS says it will help taxpayers who were misled to believe such myths.

Celebrities Are Just Like (Some of) Us

Even celebrities and business tycoons run into problems when they don’t pay their taxes. Pamela Anderson once had a $1.7 million lien against her for unpaid taxes. Duane Chapman, also known as Dog the Bounty Hunter, has owed up to $2 million in unpaid taxes at a time. Perhaps the best-known celebrity tax dodger is Wesley Snipes, who spent three years in prison and continued to battle the IRS afterward.

There’s Money in Whistleblowing

The IRS pays people to provide information on someone who did not pay taxes. The whistleblower can get up to 30% of what the IRS collects in back taxes, penalties, and interest.

You Do the Crime, You Pay the Tax

Even money earned illegally is subject to tax. Some states require drug dealers to pay taxes on the drugs they sell. The tax may be due as soon as the drug is in their possession, meaning someone caught with drugs may have to pay a fine for unpaid taxes on top of punishment for their other crimes. To pay the tax anonymously, dealers can buy tax stamps and affix them to containers of controlled substances.

There Can Be Killer Costs for Tax Evasion

Violent Chicago mobster Al Capone famously got caught on tax evasion charges. Other mobsters, including Al’s brother Ralph “Bottles” Capone, Frank Nitti, and Jake “Greasy Thumb” Guzik, were also charged. Among his debts to society, Al Capone had to pay $215,000 plus interest in back taxes.

A New Tax Law Made Millions of Children ‘Disappear’

An IRS rule change in 1987 required taxpayers to list dependents’ Social Security numbers for the first time. As a result, about 7 million children — a tenth of all dependent children in the country at the time — “disappeared.”

Taxes Have Made Delaware the Corporate Capital

Delaware has a low 8.7% flat tax on corporations, likely the reason about half of all publicly traded companies in the country consider it home. A single address in Wilmington, 1209 North Orange St., is the legal address of more than 300,000 companies.

We Had One of the Highest Corporate Tax Rates

The top marginal corporate tax rate in the United States (38.92%) was previously the fourth-highest in the world, exceeded by Puerto Rico (39%), Comoros (50%), and the United Arab Emirates (55%). But that has changed. The recent Tax Cuts and Jobs Act slashed the corporate tax rate to 21%, a little below the worldwide average of nearly 23%.

Profitable Corporations Sometimes Pay No Taxes

In spite of their size and the corporate tax rate, some large corporations have an effective federal income tax rate of zero, or even negative. In the past several years, non-payers have included General Motors, Netflix, and the bank Citigroup.

Even Ancient Greeks Had Tax Gripes

Observations and complaints about unfair tax payments go back to at least the ancient Greeks. Plato once said, “Where there is an income tax, the just man will pay more and the unjust less on the same amount of income.”

Related: Strange Taxes Around the World That We Don’t Have

Madison Square Garden Gets a Huge Tax Break

Madison Square Garden, the iconic New York sports, music, and entertainment venue, has not had to pay property taxes since 1982. The arrangement was supposed to end after 10 years, according to then-mayor Edward Koch, but due to the disputed wording of the agreement, it remains in perpetuity. The break has cost New York City an estimated $1 billion.

Some Holidays Are Meant to Be Commercialized

Several states, primarily in the southeastern part of the country, have annual sales tax holidays. Depending on the state and date, clothing, footwear, guns, school supplies, energy-efficient appliances, and other select items are exempt from sales tax for two to three days a year.

Taxes Make Witches Burning Mad

Fortunetellers, astrologers, and witches were added to Romania’s labor code in 2011, meaning they have to pay income tax and contribute to the country’s social programs. Some witches cast curses on the government in response — although others felt it legitimized their work.

Irish Artists Are Lucky

Ireland exempts up to 50,000 euros in profits from the sale of qualified artistic work from income taxes. Grants, awards, and prizes also may be tax exempt if they are related to the artist’s work.

States Offer Some Odd Deductions

Some states offer residents very odd or specific tax credits or deductions. In Alaska, eligible whaling captains can deduct up to $10,000 for whaling-related expenses. In Hawaii, property owners may be able to deduct up to $3,000 in expenses related to maintaining a tree with historic or cultural value.

Candy Can Be Complicated

What is the real difference between a Kit Kat and a 3 Musketeers? The former contains flour in its wafers, an ingredient that leads some states to label the Kit Kat a grocery item rather than candy. As a result, retailers may have to charge different taxes on the bars.

There’s a Diaper Double Standard

Some states apply sales tax to children’s diapers because they are considered clothing. The same tax does not apply to adult diapers.

Tampons Are Often Taxed As If They’re Optional

Feminine hygiene products are a necessity for many women, yet most states impose a sales tax on their sale while exempting other necessities, including groceries and medication. There are growing international and domestic movements to end the tax.

Slicing a Bagel Can Cost You

In New York, cutting a bagel turns it into prepared food, which means the store must add an 8.875% sales tax to the price.

Sin (aka Fun) Takes a Toll in Taxes

Taxes on products or services that are considered harmful are referred to as sin taxes. Some examples include taxes on alcohol, gambling, and even fast food. One example of a sin tax is Utah’s 10% tax on businesses that have nude or partially nude workers — in other words, strip clubs. The extra tax extends to drinks and food sold on the premises.

England and Russia Taxed Facial Hair

Beards are back in vogue, but there were times when having a beard was costly. During the 16th century, King Henry VIII imposed a tax on beards that increased with the wearer’s social status. Eventually the tax was dropped, but his daughter, Queen Elizabeth I, reintroduced a beard tax on anyone with more than two weeks’ worth of growth. In Russia, Peter the Great wanted to Westernize the country and required every man, except peasants and clergy, to buy a “beard token” to prove they had paid up. The tax lasted from 1698 to 1772.

A Window Tax Darkened European Homes

Talk about taxes’ ability to darken a day — in 1696, a window tax was introduced in England and Wales. It was assessed as a flat property tax plus a tax based on the number of windows a home had. As a result, some people bricked up their windows and new buildings sometimes were designed with fewer windows. Scotland and France imposed similar taxes in the 1700s.

The Romans Taxed Urine

In Roman times, urine and the ammonia within it were collected for uses such as tanning and laundering. Emperor Vespasian imposed a tax on the buyers of urine from public urinals. Today words for “urinal” in French, Italian, and Romanian are derived from the emperor’s name.

Britain Had a Hat Tax

From 1784 to 1811, the British government taxed hats based on price. A stamp was pasted inside the hat, and anyone caught with a stamp-less hat had to pay a fine. At least one stamp forger was sentenced to the harshest penalty: death.

U.K. Citizens With Color TVs Pay More Tax

In England, residents must pay a license (or, ahem, licence) fee for each TV in their homes. The money from this annual fee goes toward funding the BBC. In 2024, the cost is £169.50 for a color TV and £53.50 for a black-and-white TV. The blind pay half as much.

In Denmark, the Tax Can Cost More Than the Car

U.S. car buyers pay sales tax, and there are fees for registering a vehicle, but they don’t come close to what Danish car buyers pay. Depending on the price of the car, the registration tax can be as high as 150% of the sale price.

Related: 14 Signs The Car Dealership Is Ripping You Off

It’s Not Certain Ben Franklin Was First With That Famous Quote

As Benjamin Franklin said, “In this world nothing can be said to be certain, except death and taxes.” Although he’s often credited with the idea, that line comes from a 1789 letter, and similar quotes date to 1716 and 1724.

But They Can Be Delayed

And while taxes may be inevitable, they are not immutable in an emergency. Because of the COVID-19 pandemic the federal government pushed the tax filing deadline to July 15 in 2020. In 2021, the deadline was pushed to May 17. This year, however, Tax Day is April 15, except for taxpayers Maine or Massachusetts. They have until April 17 due to the Patriot’s Day and Emancipation Day holidays. Happy filing!