Setting your bills to autopay might seem like a great way to never miss a payment, avoid late fees, and build credit. But it also makes it easy to stop paying attention, lulling you into overspending and unintended consequences. It can be a big problem for monthly bills with variable amounts, or if you sometimes don’t have enough money to cover all your monthly expenses in your bank account.

Which bills should you avoid checking that autopay button on? Here are several that you should only pay the old-fashioned way.

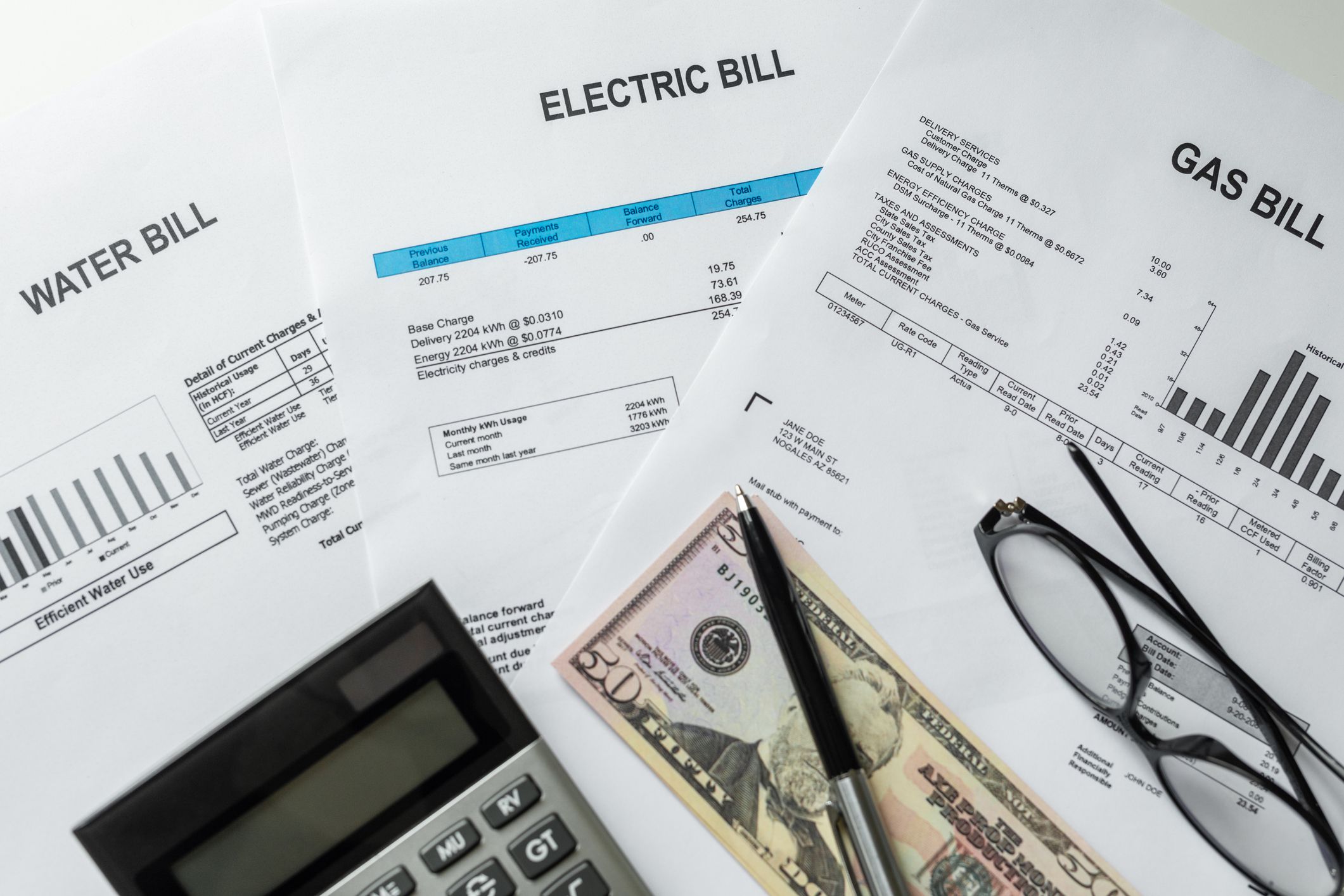

Utility Bills

Electric, gas, and water bills can vary significantly based on factors such as the season and the presence of houseguests. Chances are, you’re already aware of these typical fluctuations, and you’d be able to spot any significant changes that come from an error, faulty meter, or even a water or gas leak. If they’re on autopay, you’re more likely to miss a significant problem.

Cable or Satellite Bills

You may think your cable bill stays the same every month, but paying attention reveals that it often increases. Cable companies are notorious for adding fees for everything under the sun, and god help you when those promotional offer periods end.

Cell Phone Bills

Just like cable bills, cell phone bills increase on their own all the time thanks to ridiculous fees. It’s even worse if you’re on a plan that doesn’t include unlimited data, phone calls, or text messages. It’s always best to check your monthly bill for anomalies — especially if you have kids who use your phone or teens on your family plan.

Annual Subscriptions

You can often save money on subscription services by signing up for an entire year at a time instead of paying monthly. But it’s easy to forget when that auto debit is coming, and you might not have enough money in your account for a large withdrawal. Plus, in the case of something like a Costco membership, you might find that you go so little that it’s no longer worth the price anymore.

Gym Membership

Unless you’re a gym rat, likely, you’re not using your gym membership regularly enough to justify the monthly price. Gym employees are great at talking people into autopay and annual memberships, too, which can make for a big surprise withdrawal.

Trending on Cheapism

Free Trials

We’ve all signed up for free trials and then gotten bitten by the autopay feature that’s inevitably turned on by default. When signing up for a free trial service, double-check that the autopay option isn’t activated, or you’ll be sorry.

If the free trial requires you to leave autopay on, set up a reminder on a smart device a couple of days before the trial ends to cancel it.

Streaming Services

If you’ve cut the cable cord, chances are you did it to save money. Streaming services are getting more and more expensive, though, and it’s easy to lose track of which ones you’re actually paying for if you don’t use them regularly. Paying your Netflix, Disney+, and Max subscriptions monthly ensures you only pay for what you actually use.

Subscription Boxes

Subscription boxes for things like Japanese snacks and kids science experiment kits are fun for a while. Eventually, they get repetitive, boring, or the novelty wears off. Don’t inadvertently sign up for another whole year by putting that monthly gift box delivery on autopay.

Sign up for our newsletter

Newspaper Subscriptions

Newspapers often lure you in with enticing introductory rates, but the renewal price can skyrocket when that promotion ends. If you put your subscription on autopay, you may end up paying much more than you expected when your renewal hits.

Keeping it off autopay ensures you’ll remember to shop around for better deals or even consider whether you still want the subscription at all. It’s a simple way to stay in control of your budget and avoid being stuck with a subscription you don’t need.

More Personal Finance Tips From Cheapism

- 5 Small Debts That Can Wreck Your Credit Score — Beware these five small debts that can hurt your credit standing, and pay attention to eight tips that can help keep your score in the green zone.

- 13 Signs You’re Doing Better Financially Than You Think — The media can sometimes make you feel like you are not doing so great in the finance department. Here are 13 signs that say otherwise.

- 10 Mistakes to Avoid When Creating a Household Budget — Creating a household budget is a challenging task, but it’s also one of the most necessary.