If you live in a state like California or New York, you might be shocked to learn that some states don’t charge income taxes. Sounds like a dream, right? But before you start packing your bags, it’s worth clearing up some misconceptions. To begin with, you’re still going to have to pay taxes on property, goods, and services. And secondly, states that don’t charge income taxes suffer from other problems, like high sales-tax rates and underfunded public services, both of which hurt low-income Americans. Rather than glossing over those details, we’ve contextualized our list of income-tax-free states by including metrics from WalletHub such as overall tax burden and taxpayer return on investment.

Note: The taxpayer ROI ranking referenced in each slide is based on the state’s placement among all 50 states, with 1 being the best.

Alaska

With the lowest tax burden of all 50 states and an impressive return on public spending, Alaska is the place to be for angry libertarians and other tax-averse Americans. That said, it’s not exactly a paradise. WalletHub’s ROI analysis found that the state had one of the worst ratings in education and water quality.

Florida

Florida taxpayers get their money’s worth for their taxes, especially given the state’s robust public education system. On the other hand, the state lags behind when it comes to healthcare, ranking in 37th place behind high-tax states like California, New York, and Hawaii.

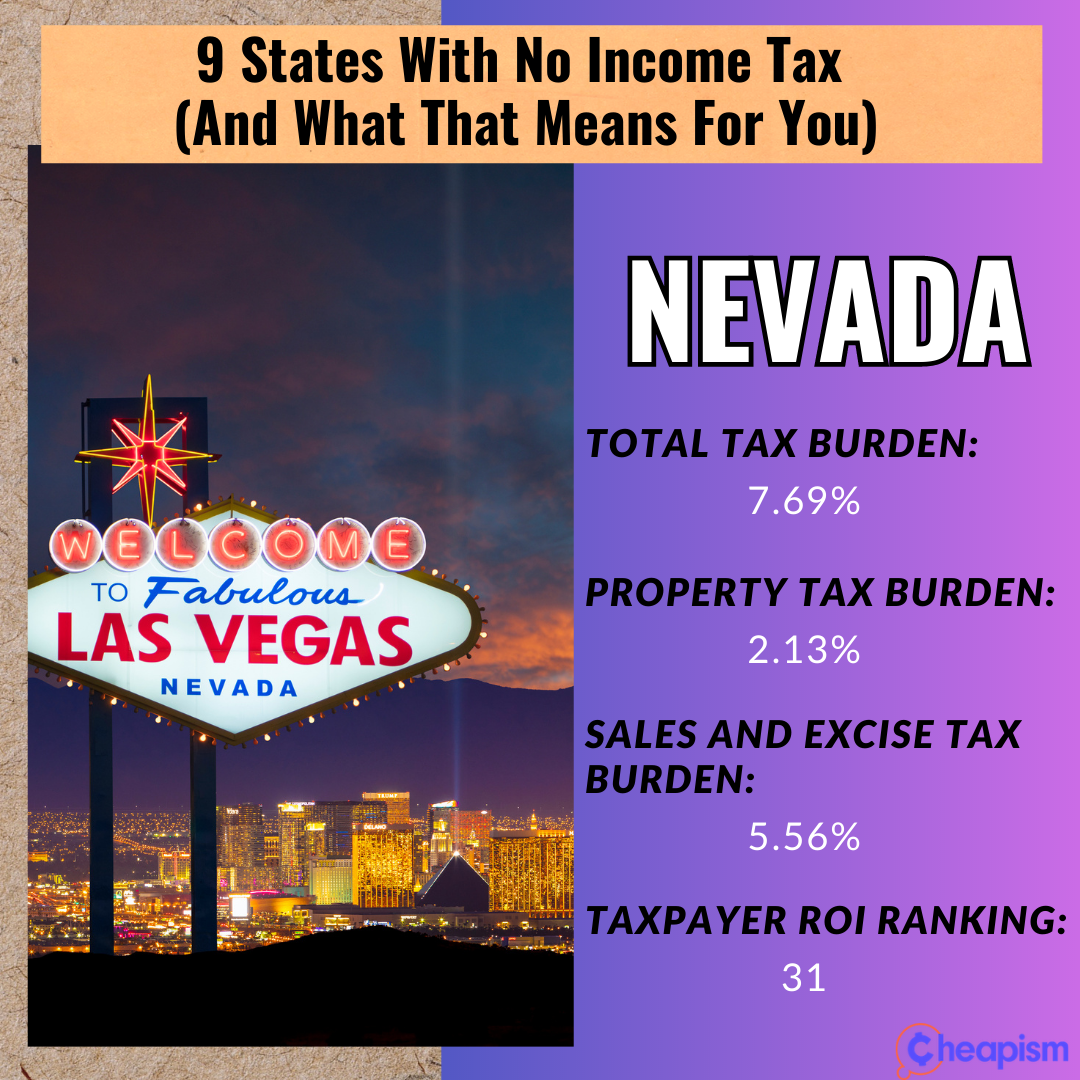

Nevada

Nevada’s taxpayer ROI suffers because of its dismal last-place economy score, which is based on metrics like median household income and unemployment. Besides the lack of income taxes, the only upside is that Nevada has some of the best roads and bridges in the country.

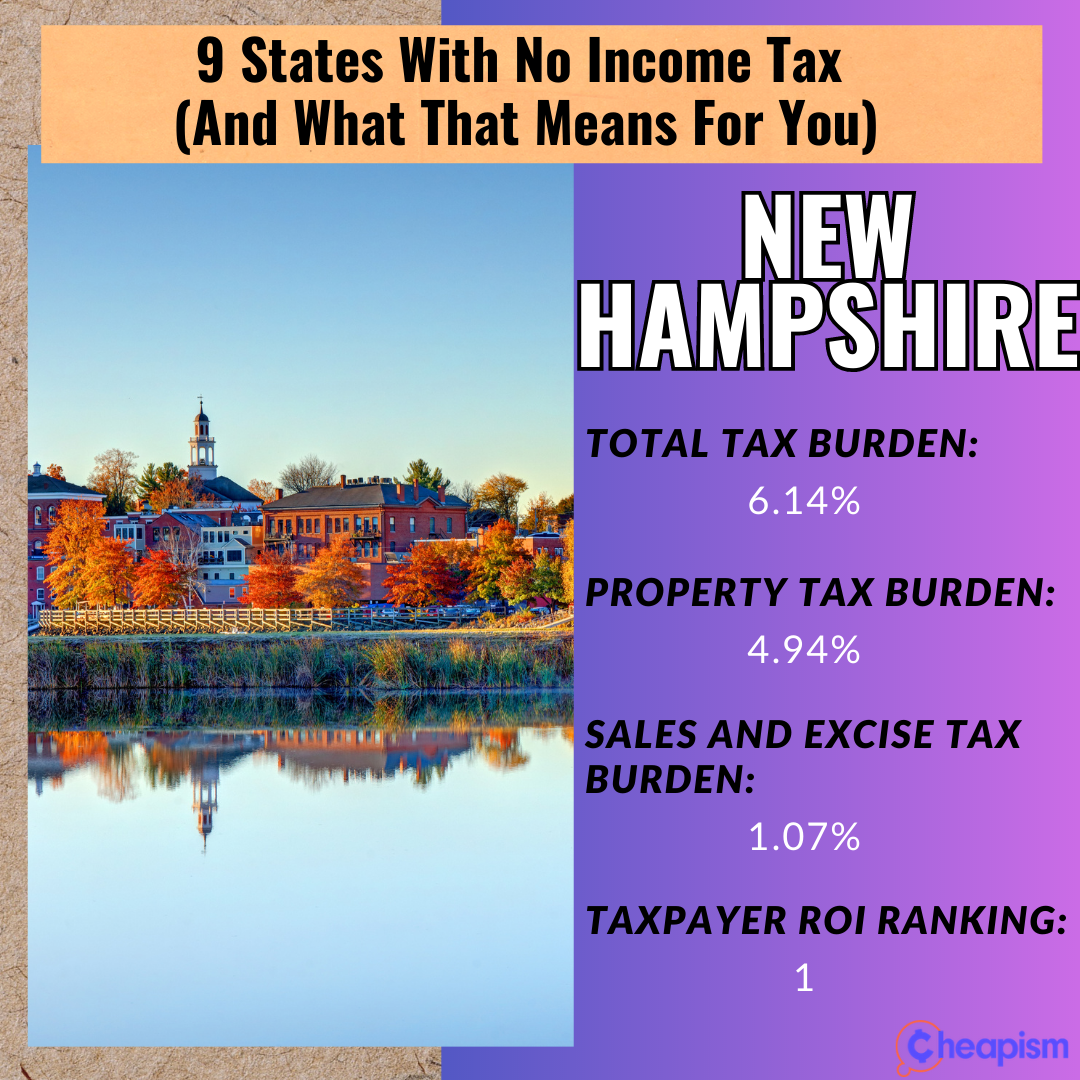

New Hampshire

Despite its nonexistent sales tax (cigarettes and gas are taxed separately), New Hampshire offers some of the best government services in the country, earning high economy and education scores. It also has the fewest proportion of residents in poverty and one of the lowest violent crime rates, making it the safest state on WalletHub’s list. Investments are taxed at 5%, though that percentage will phase out by 1% every year until it hits zero in 2027.

South Dakota

Prepare for a bumpy ride in South Dakota, as the low-tax state has some of the worst roads and bridges in the country, according to WalletHub’s analysis. However, the Mount Rushmore State makes up for poor infrastructure with a healthy economy, ranking far above economic powerhouses California and New York.

Trending on Cheapism

Tennessee

Tennessee has the best and worst of low-tax states. On the one hand, it nabs the first-place spot for bridges and roads. But then you look at the state’s violent crime, which is tied with four other states for the highest rates in the country.

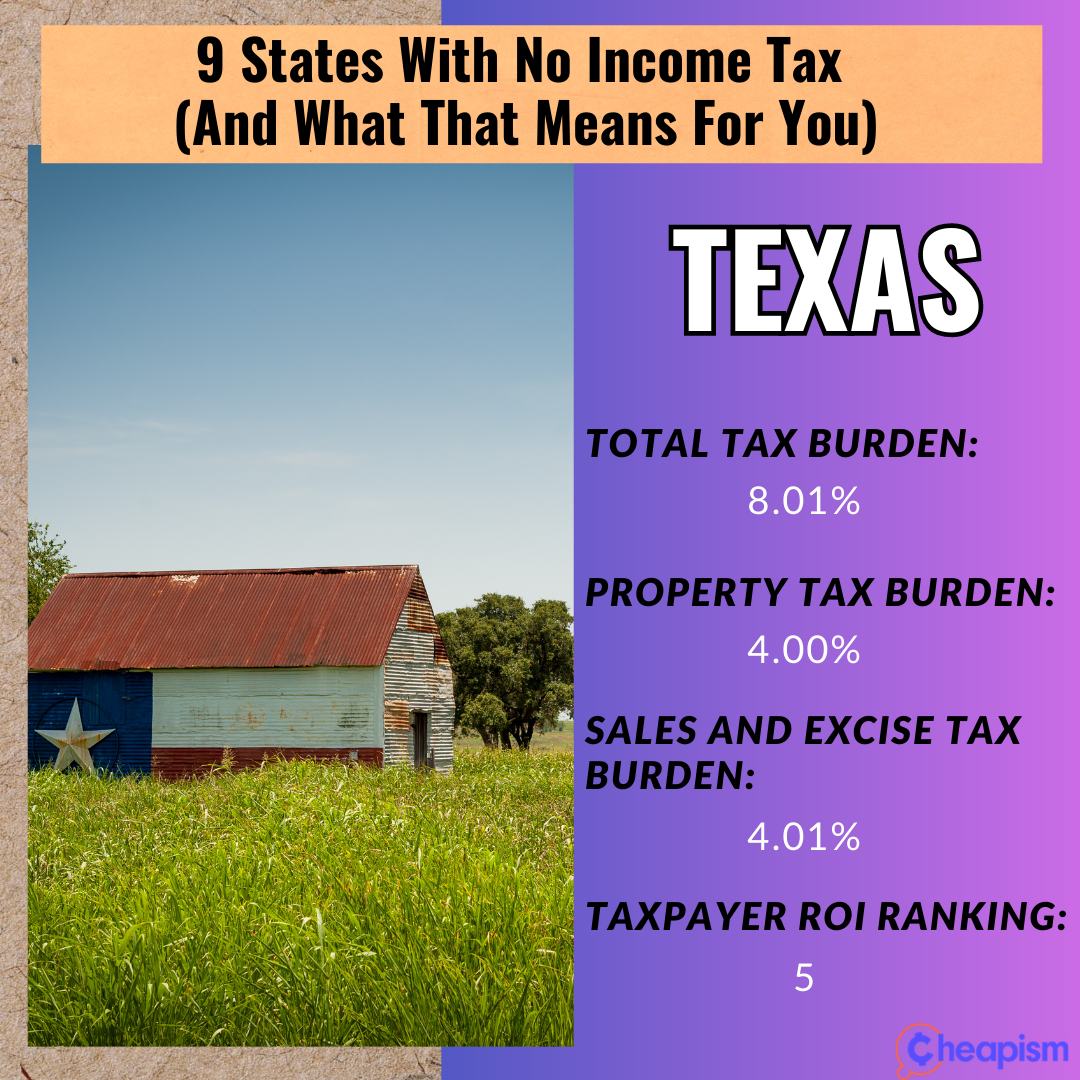

Texas

Californians fleeing the Golden State’s high taxes often decamp to Texas, where income tax rates are zero. But the state government has to get its funding somehow, so they charge relatively high sales and property taxes.

Washington

Out of all the states with zero income tax, Washington ranks the lowest on taxpayer ROI, receiving middling scores for its government services. The Evergreen State also has a relatively high tax burden thanks to its capital gains, sales, and gas tax rates.

Sign up for our newsletter

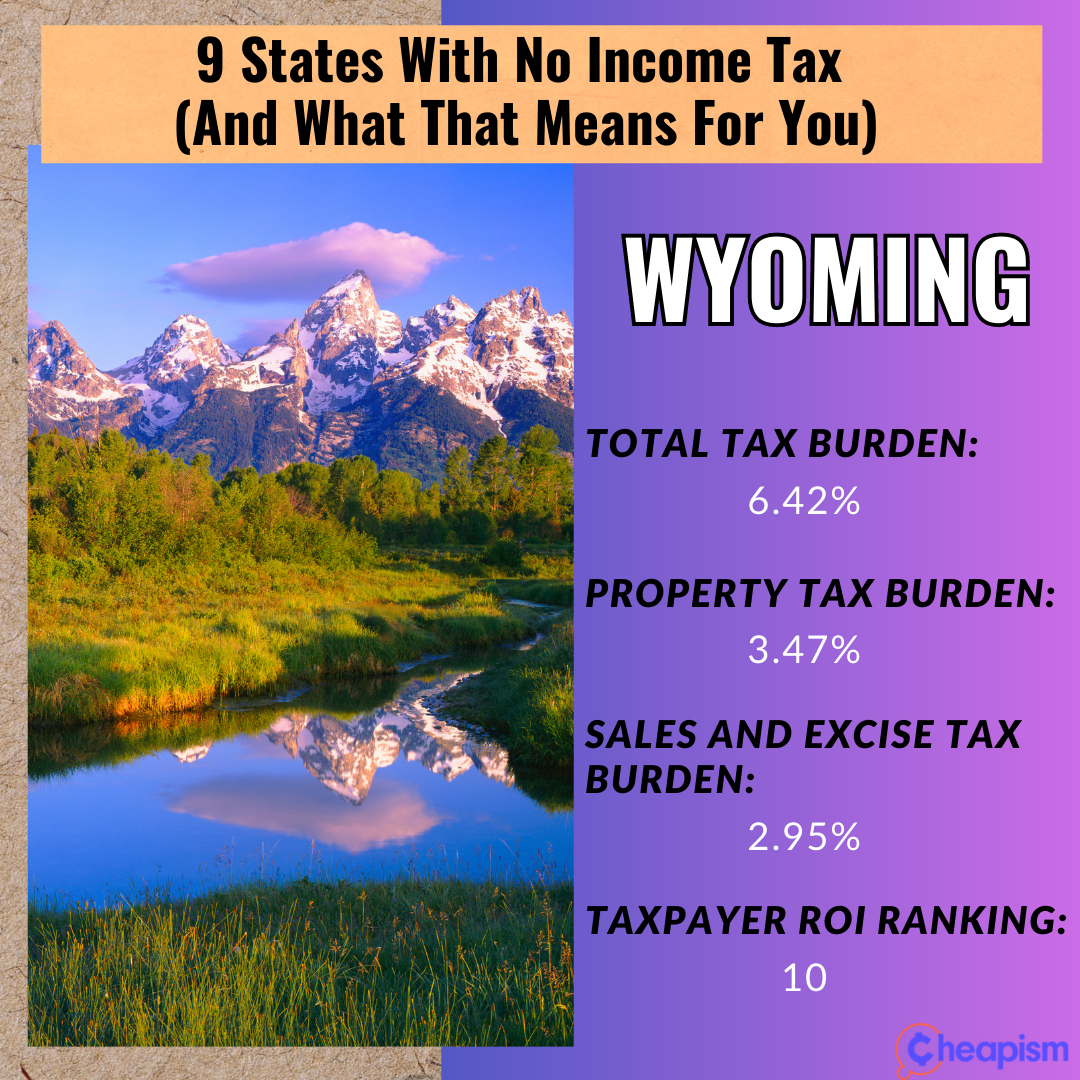

Wyoming

With half the tax burden of a New Yorker, Wyomingites can keep most of their money from Uncle Sam. And the consequences don’t seem to be too severe, as the state earns mediocre scores across the board for its public services. Its lowest ranking is in healthcare, where Wyoming comes in 39th place.

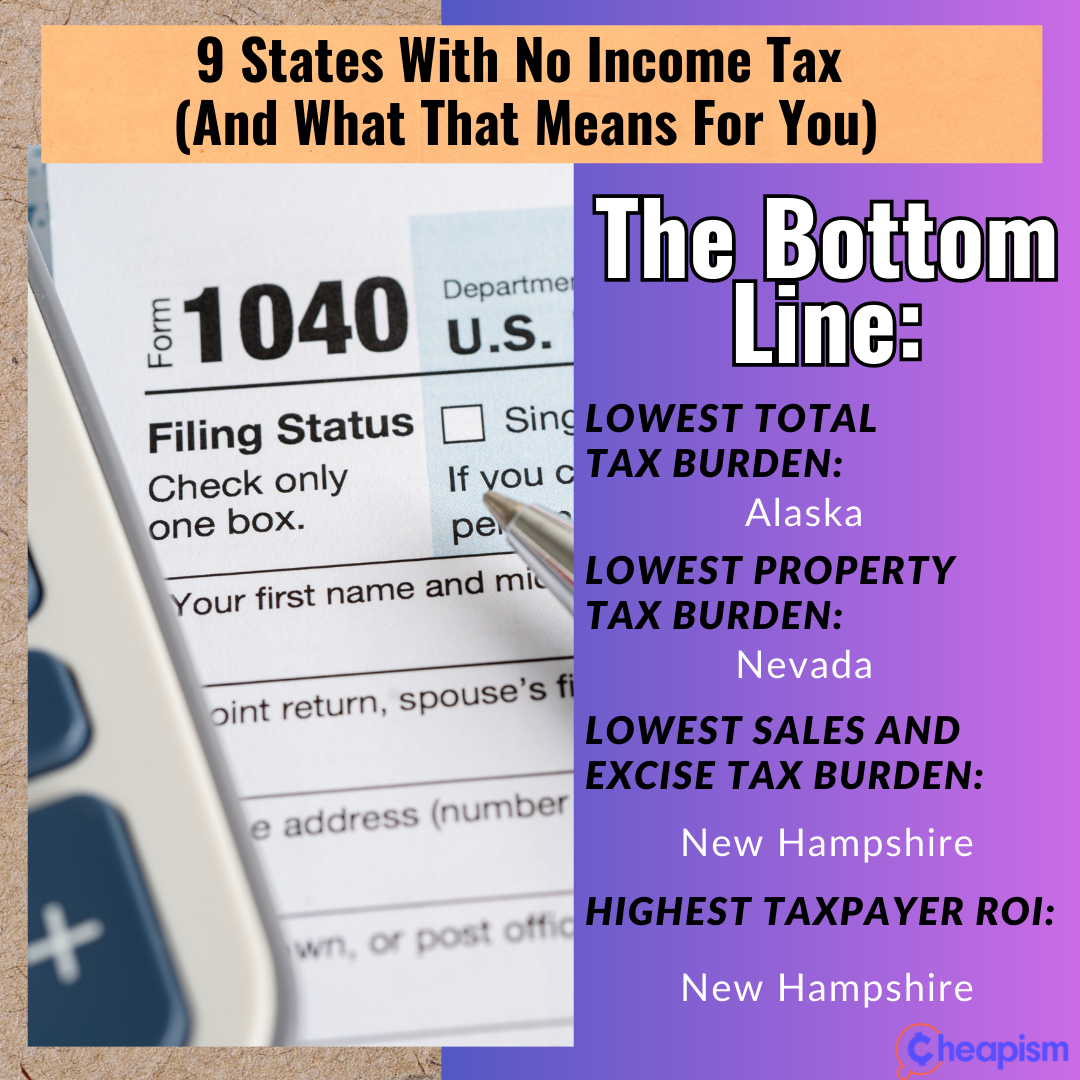

The Bottom Line

Whether it’s a high sales tax or a dismal healthcare system, states that don’t charge income taxes come with their own drawbacks. And taxed income is only part of the picture. Once you begin to think about the cost of living, job opportunities, public transportation, and the quality of a state’s government services, it’s clear that taxes are just one aspect of affordability and quality of life.