Personal Finance

-

9 Incredibly Out-Of-Touch Things Rich People Say That Will Make Your Blood Boil

You’d think that rich people would be a little more self-aware. But then they go and do things like the “Imagine” video, and it hits you — they really don’t get it. It’s the same old tone-deaf story. Just look…

-

‘Pulling Yourself Out of Poverty’: How Struggling Redditors Turned Their Lives Around

Despite the United States’ immense wealth, around 38 million people still live in poverty. Much of that poverty is structural, the result of discrimination and the country’s paltry social safety net. But in the face of this stark reality, a…

-

Maybe Happiness Can Be Bought: Actual Life-Enhancing Purchases

You’ve likely heard someone say that “money can’t buy happiness.” And while the wizened sentiment certainly holds its weight in certain situations, and happiness as a passing emotion does possess its own mystical quality, there are certain purchases that stand…

-

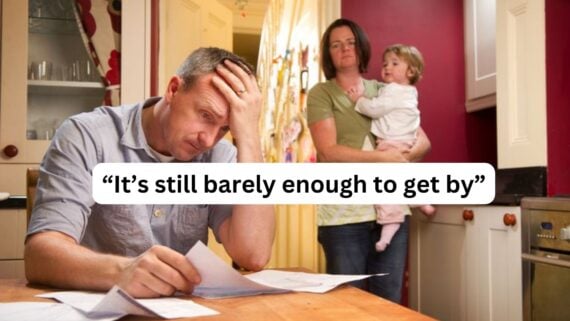

‘Is $50 an Hour the New Middle Class?’ TikToker Questions What Defines a Livable Wage

Inflation is insane. The cost of living is crazy. Wages are out of whack. And we’re all left wondering where the hell our paychecks went after we paid the bills and filled the fridge. If you’re making just enough money…

-

‘To Say I Was Furious Was an Understatement’: Employee Stiffed on Overtime Plots Long And Pricey Revenge

Sometimes, the best revenge of all ends up being the one that requires cooler heads to prevail, patience, and the nerve to see the revenge through when it’s time. Revenge is, after all, a dish best served cold. Such was…

-

‘Charging More for Less’: Netflix Customers Outraged With Second Price Hike in a Year

In a world where inflation seems to be the new trend, Netflix, not to be outdone by the price of avocados, has decided to raise its prices for the second time this year. In a letter to shareholders, the streaming giant…

-

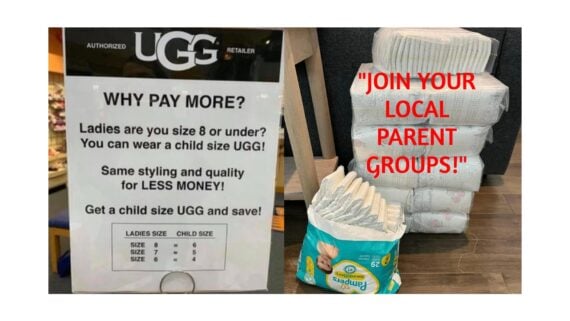

‘I Really Want To Do This’: People Share Their Truly Brilliant Tips On Being Frugal

Frugality is its own kind of art form in this day and age. We wish it were far easier to save money, but the reality is that places like the…

-

8 Brilliant Go-To Frugal Holiday Gift Ideas

The holidays can creep up on us all out of nowhere. Especially when you find yourself absolutely buried in work, competing in the ever-demanding landscape of a world that the…

-

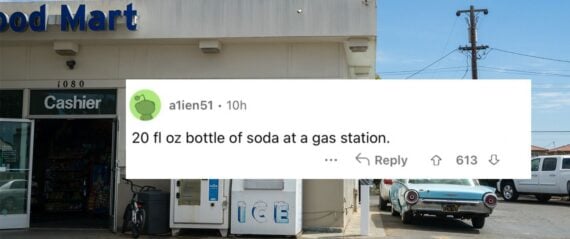

Even More Expensive Things That Just Aren’t Worth It Anymore

There seems to be an entirely inevitable, escalating series of discussions from our friends over on Reddit about how the cost of living is rising at an aggressive pace, and…

-

5 ‘Quiet’ Luxury Brands That Only the Super Rich Know About

Access to the world of millionaires and billionaires is exclusive by definition. Here’s an example. You’ve probably never heard of the Centurion card from American Express, and even if you…

-

Angry Shoppers Are Breaking Up With Amazon After It Quietly Raised Its Free Shipping Minimum

Back in August, eCommerceBytes broke the news that Amazon would be testing a new free shipping threshold, raising the minimum from $25 to $35. Although Amazon confirmed the change, it…

-

How To Actually Save Money At Costco

There can be an ocean span of a difference between actually getting the most out of a grocery shopping haul at your nearest Costco, and then falling prey to doing…

-

12 Products That Don’t Work As They Should, Yet People Still Buy Them

Many of us are capable of carrying onward with profound levels of stubbornness when it comes to continuing to buy lousy products and/or stay signed on for seemingly purposeless subscriptions,…

-

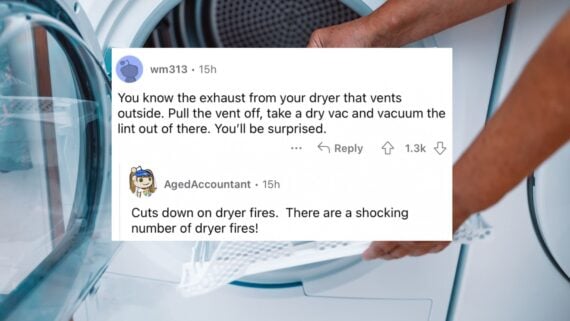

12 Home Maintenance Tasks You Should Be Doing

Making repairs around your home — as opposed to hopping on the phone and calling someone else up to come through your home to see to it that everything doesn’t…

-

Genius Hack Shows How To Turn a Beer Can Into a Camping Stove

Camping aficionados and travel enthusiasts are always on the hunt for ingenious methods to simplify their outdoor experiences. Here at Cheapism, we love the art of re-purposing everyday items in…

-

10 Cheap and Easy Hacks That Replace ‘Normally Expensive’ Items

In the good old days, five bucks felt like a small treasure (I swear my parents stay boasting about how they could buy “so many snacks” with just $5). But…

-

10 Frugal Wins From Cheap Geniuses

We are all for anyone who takes the time and effort to cut down on the steadily rising costs of living through various ingenious acts of top-tier frugality. With outings…

-

Lavish Purchases People Somehow Still Afford

While there are folks out there who have done well for themselves and ended up with the kinds of financial portfolios where they can afford the plastic surgery outings, the…