Credit cards now hold more than $800 billion of U.S. consumers’ $13.5 trillion in debt, according to the Federal Reserve Bank of New York. That isn’t as much as mortgage debt ($9 trillion) or auto loan debt ($1.3 trillion), but it also isn’t being paid off the same. Roughly 5 percent of credit card debt is past due, compared with just 2.3 percent of auto loans and 1.2 percent of mortgages. Only student loan debt has a worse track record at $1.4 trillion, 9.1 percent of which is past due. People make a lot of mistakes with their credit cards, and we consulted financial experts to find out just how many.

CARRYING A BALANCE

The average credit card balance is $8,195, according to CreditCards.com, and would take the average household 13 months to pay down when applying 15 percent of their income. Meanwhile, the FICO score used by credit bureaus to determine credit health values a spotless payment history (35 percent of a FICO score) and the amount of debt a cardholder carries in relation to their credit limit — or their credit utilization (30 percent) — more than anything else.

CHARGING EVERYDAY ITEMS

Especially since people spend more with credit cards than paying cash, don’t get saddled with more debt and pay more interest by flashing plastic for every little thing. Pay with cash or debit cards, or at least buy only what you can cover in a month.

MAXING OUT A CARD

Maxing out that credit utilization score sends your credit score plummeting. Even if you continue to make payments on time, it may not be enough to help. If you’ve maxed out, Todd Ossenfort, chief operating officer for Pioneer Credit Counseling, suggests you stop using the cards, increase your payments, and rein in spending until the cards are paid off.

PAYING LATE

Some 21 percent of Americans have made a delinquent credit card payment at least once in their lives, according to NerdWallet. Just for one first-time late payment fee — $15 to $35 — that’s more than $1.4 billion in fees alone. Many just forget to make the payment (35 percent), while other need the money to pay for essentials (33 percent) or for an unexpected emergency (32 percent). Those late fees only get higher the more late payments you make, so watch yourself.

GETTING CHARGED OFF

If you miss enough payments, your account will simply be charged off: Closed to future charges at a loss for the issuer. As consumer education specialist Jennifer White at credit agency Experian points out, you’ll still be on the hook for the past-due amount and the balance owed. Even if you pay it, a “paid charge-off” stays on a credit report for seven years. You may also have your charged-off account sold to a collection agency, which you’ll have to deal with to settle your debts.

Trending on Cheapism

NOT REPORTING A LOST OR STOLEN CARD

Federal law limits liability for unauthorized charges if your card is lost or stolen, but Federal Trade Commission gives that an asterisk: “Your protection against unauthorized charges depends on the type of card — and when you report the loss.” That means you need to report that card as soon as you realize it is gone, preferably through the 24-hour service most card issuers have in place.

APPLYING FOR TOO MANY CARDS

It’s a fiction that “the more credit cards you have, the better,” Joe O’Boyle of O’Boyle Wealth Management told TheStreet. “If you open a bunch of credit cards at once, that can negatively impact your credit score. Get your credit increased later.” New accounts make up 10 percent of your FICO credit score, while the length of your credit history makes up 15 percent. Hard inquiries from credit firms during the application process pull down your credit score, while new cards represent fresh credit history.

PICKING THE WRONG CARD

How do you spend? Where do you spend money the most often? How often do you carry a balance? How much of a spending limit are you comfortable with? If the terms of the credit card you’re looking at don’t match the answers to the questions above, it likely isn’t the card you’re looking for, Pat Curry at CreditCards.com says.

Sign up for our newsletter

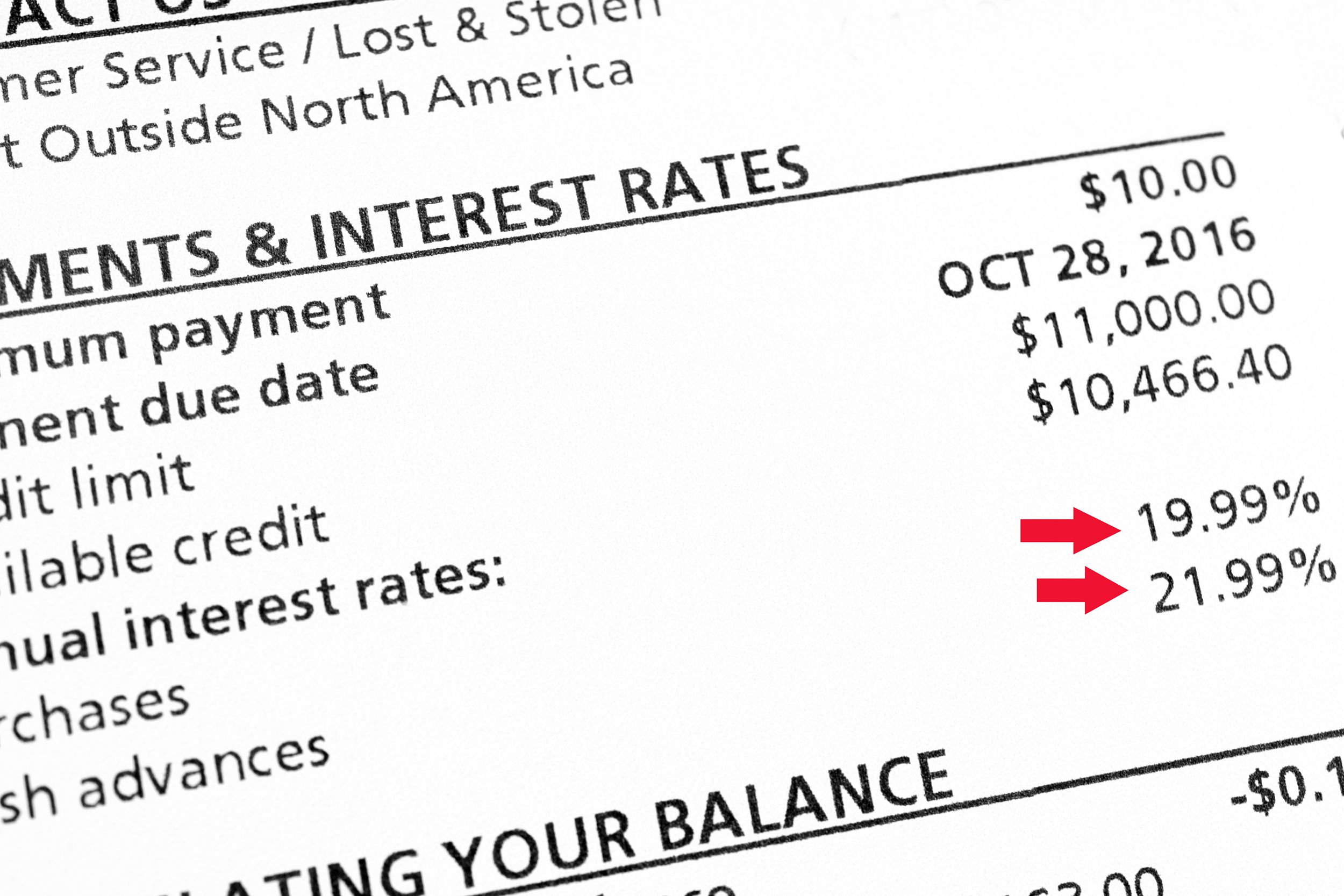

FALLING FOR INTRODUCTORY RATES

Cards offering zero percent interest upfront often end up charging significantly steeper fees down the line, the Consumer Financial Protection Bureau says. The CitiRewards+ card offers zero percent interest, but only for 12 months and only on balance transfers, for example, and its standard interest rate falls between 15.74 percent and 25.74 percent. Before jumping at a zero percent interest rate, see what it applies to, how long it applies, and what happens if you don’t pay a balance in time.

TAKING ON DEFERRED INTEREST

That higher rate isn’t the only pitfall hiding behind a zero percent interest offer. Deferred interest is an unpleasant surprise to consumers who reach the end of that zero percent interest term only to find they’ve been charged interest on purchases retroactively – and steeply. Consumers are charged a 24 percent interest rate on average for deferred-interest promotions, costing consumers $2 billion in 2016, up 10 percent from a year earlier, the Consumer Finance Protection Bureau says.

CARRYING TOO MANY CARDS

Even folks with high FICO credit scores can have several credit cards, but remember that “type of credit” accounts for 10 percent of a credit score and can throw it off, says Barry Paperno at CreditCards.com. Though having too few cards can also throw off a score, it’s better to have a handful of good cards with reasonable limits that can be paid off easily than have an array of cards where a lingering balance can affect on-time payments and overall credit utilization.

LENDING SOMEONE A CREDIT CARD

Thirty-six million U.S. adults have had a negative experience lending a personal credit card to someone they know, according to a CreditCards.com study. Among that group, 19 percent lent it to someone who overspent, 14 percent were never repaid, and 10 percent didn’t get the card back at all. “You really are playing with fire when you let someone else use your credit card, so proceed with caution,” said CreditCards.com senior industry analyst Matt Schulz. “Whether they spend more than you anticipated, don’t pay you back, or you never see the card again, ultimately, you are the one who is responsible.”

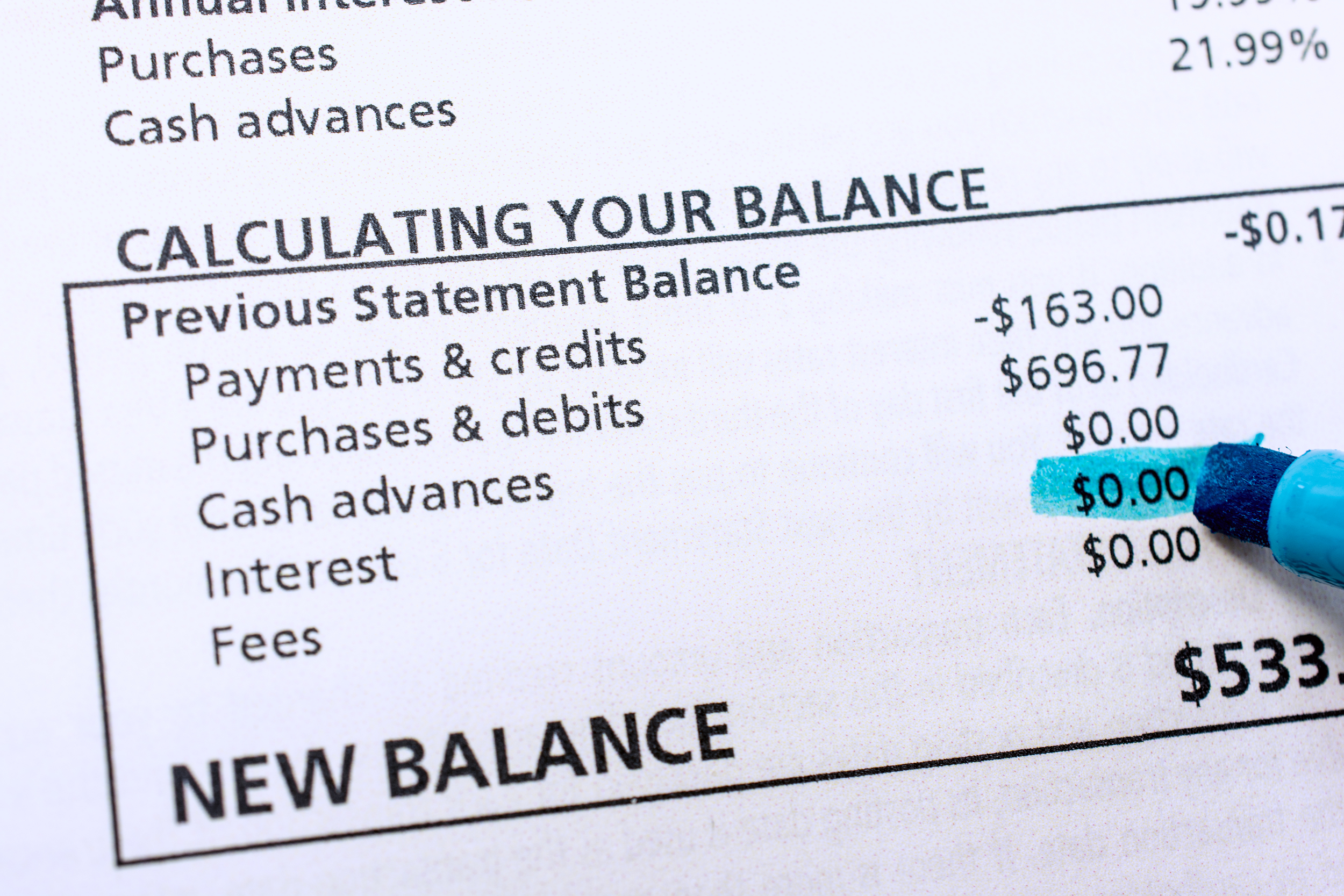

NOT CHECKING STATEMENTS

Credit card statements can help you avoid late payments, but are also the best way of knowing if a charge is correct. A consumer typically has 60 days to dispute a payment amount; if you ignore your statement and fraudulent charges, you’re basically accepting them. “In these days of ID theft, you need to check your bills religiously,” said June A. Schroeder, a Wisconsin certified financial planner, to CreditCards.com.

ABRUPTLY CLOSING A CREDIT CARD ACCOUNT

If you keep your cards paid off and just want to close a superfluous card, it may not be a problem; if you carry balances and close one of your few cards with no balance, you’re increasing your credit utilization percentage and decreasing your score; close a long-tenured card and you’re decreasing it by shortening your credit history. You can cancel cards with an active balance and close cards that charge you a whole lot of fees and still have excellent credit to show for it, CreditKarma says.

NOT READING THE FINE PRINT

You’ll know more about interest rates if you read the agreement that comes with the card. Details about the fees you’re paying, interest rates, and card terms agreement are all in that fine print. But the average agreement was 4,900 words in 2016, CreditCards.com noted, despite the Consumer Financial Protection Bureau urging issuers back in 2011 to cut the length and complexity; its model was 1,188 words.

NOT BUDGETING

Setting a budget improves mental health and well-being. Roughly 62 percent of budgeters “feel more in control” over their money with a budget, 55 percent feel more confident, and 52 percent feel more secure, according to a survey by the Certified Financial Planner Board of Standards. And among the roughly 70 percent of people who have a budget, 72 percent say it helped them get out of debt. Credit cards can help keep a budget, because they track expenses — but shouldn’t be used in lieu of one.

PAYING ONLY THE MINIMUM BALANCE

Your minimum payment of 3 percent of your balance or $25, whichever is greater, seems completely reasonable, right? Well, if you have a card with the average interest rate of 17.55 percent and carry the average credit card debt of $6,929, it will take 15 years and three months to pay what you owe if you just pay the minimum. “If you’re counting on making only your card’s minimum payment, you could end up paying much more in interest than you’d save on the deal,” says Lisa Lake of the Federal Trade Commission.

TAKING CASH ADVANCES

Typically, if you pay off a balance in full each month, there’s a grace period of at least 21 days to pay off new charges without interest. Cash advances get no grace period. “If you withdraw cash from an ATM with your credit card, that is considered a cash advance, and interest will accrue immediately,” says Matt Schulz, senior industry analyst at CreditCards.com. Cash advances also have different rates and require an additional fee.

NOT UNDERSTANDING INTEREST

“You can’t just take your balance and multiply it by 14.99 percent and get your extra payment for the month,” says Brooklyn Lowery, editor at CardRatings.com. Annual percentage rates are for the year and not a monthly fee. Sites such as CardRatings provide rate calculators to show cardholders how much interest they’ll pay each month.

EXCEEDING YOUR LIMIT

Thanks to the Credit CARD Act of 2009, card issuers can no longer process charges that put you above your credit limit — they’ll simply deny the charge. But you can still opt in to allow charges beyond a credit limit: possibly $25 the first time you exceed your credit limit and up to $35 if you if you go over again within six months. A fee cannot be larger than the amount by which you exceeded your credit limit.

PAYING TO INCREASE YOUR LIMIT

Raising a credit limit on your card? First Premier Bank charges $25 for the privilege, and with a $100 credit limit increase, a $25 fee is a fairly big deal. “These cards are targeted at folks with less-than-stellar credit,” Schulz says, calling it “one of the most egregious” fees.

PAYING MYRIAD LITTLE FEES

That same First Premier Bank card charges a $4 internet access fee, a $3 copying fee, a $5 wire transfer fee, and an $11 autodraft fee. CardRates singles out the Continental Finance MasterCard and its $200 upfront “finance fee,” $50 annual fee, $12 per month account fee, and the $25 fee for credit limit increases as a “Worst Card of All Time,” but any card that chips away with small fees should be avoided at all costs.

SPENDING FOR REWARDS

If a $100 dinner with friends puts you over the minimum spending for a 50,000-point sign-up bonus on a rewards card, picking up a tab just to earn credit card rewards may be worth it — and 47 million Americans have done such a thing, CreditCards.com says. But with a credit card with a quarterly 5 percent cash back bonus on restaurant spending, a $100 restaurant tab for yourself and four other people will earn back just $5. If no one pays you back, you might pay $95 for a meal instead of $15. You can rack up a lot of rewards buying groceries or gas and immediately repaying your balance, but don’t think you’re breaking even.

PAYING FOREIGN TRANSACTION FEES

Cards such as the CapitalOne Venture, Chase Sapphire Preferred, and Discover It Miles are in the overwhelming minority for not charging transaction fees to travelers abroad. CreditCards.com puts the average foreign transaction fee at 1 to 3 percent, which isn’t always so slight, depending on the traveler. “It’s not uncommon for them to go up to 5 percent per transaction,” Lowery says. “If you come home and it’s cost you 5 percent plus whatever the conversion is, it can put kind of a damper on that post-vacation glow.”

NOT ASKING YOUR CARD ISSUER FOR HELP

Eighty-five percent of credit card holders who asked for a late fee to be waived got what they were looking for, 70 percent got annual fees lowered or waived, and 56 percent got a lower interest rate, according to a CreditCards.com survey. But only one in four cardholders ever asks. “People have far more power with their credit card company than they realize,” Schulz says. “Competition among card issuers is incredibly high these days, and customer retention is a priority.”

EXPECTING TO AVOID ANNUAL FEES FOREVER

Some card issuers will waive a first-year annual fee, but that’s likely it. If the issuer offers fee-free balance transfers or zero percent APR, expect that to be temporary as well. While active military and persistent cardholders may be able to get fees waived, the waivers are fleeting. If you’re able to recoup more in rewards or points than the amount of the fee, that card may earn its keep.

TAKING A SUBPRIME CREDIT CARD

“In a lot of ways, the people who need the credit most are going to pay the highest fees and the highest rates to get it,” Lowery says. According to the 2012 Census, an estimated 48 million Americans (20 percent of adults) have credit scores below 600, leading them to subprime credit cards with annual fees of as much as 25 percent of a card’s credit limit and APRs near or exceeding 30 percent. Those cards include application fees, processing fees, maintenance fees, and authorized user fees adding up to $150 a year, or $2.5 billion for all subprime cardholders. Those cardholders get cardholder agreements that are 70 percent longer, on average, than the typical and written at a level suitable for someone with two years of college — but more than half of mailings from subprime card issuers went to households with no education beyond high school.

CHARGING MEDICAL BILLS

Up to 27 million U.S. adults were putting medical expenses on cards, costing more than $12 billion annually, NerdWallet found In 2017. An average American’s part of that is $471 in interest. It also takes an average 70 months to pay these balances off. “Charging medical bills to credit cards can seem like a simple solution, but it can actually lead to even bigger headaches down the road,” said Kimberly Palmer, NerdWallet’s credit card expert. “Instead, ask your doctor or hospital if you can arrange an interest-free payment plan.”

KEEPING A HIGH-INTEREST CARD

If you have $5,000 outstanding on a credit card, a zero percent balance transfer offer (assuming a 3 percent balance transfer fee and a 12-month zero percent introductory APR) would let you pay that off within a year for $5,150 — better than for someone paying a 28.45 percent penalty rate for $5,803 over 12 months. Even carrying a standard 15 percent APR, it would cost $5,415 to pay off that balance. “Timing is everything when it comes to balance transfers,” said Matt Schulz, CreditCards.com’s senior industry analyst. “It’s absolutely critical that you not wait to transfer your balance to your new card, but it’s even more important that you pay that whole balance off before the introductory period ends.”

PAYING BALANCE TRANSFER FEES

Even transferring a balance to a zero percent APR card, most credit cards will charge 3 to 5 percent of the balance. Some offers will waive the fee, but only for about 90 days. “That will probably still save you a ton of money … but you still need to figure that transfer fee into the balance you’ll have to pay off,” Lowery says.

NOT KNOWING YOUR CREDIT SCORE

A credit score above 800 is considered excellent; 700 to 740 or above is good; 650 to 670 or above is fair; and 550 to 580 or above is poor. Below that is very poor. According to CreditCards.com, the national average for credit card APR is 17.55 percent. The difference can mean 15.18 percent APR on a low-interest card and 24.89 percent APR on “bad credit” cards. If you don’t know your credit score, you can’t improve your credit: Find a participating bank, credit union or credit card issuer and check your FICO score for free.

COSIGNING ON A CREDIT CARD

Bank of America, U.S. Bank, and Wells Fargo allow people to cosign on credit cards for those without strong credit. American Express, BarclayCard, Capital One, Chase, Citi, and Discover do not, which should give you some idea of what most issuers think of the practice. A credit card cosigner is on the hook for late payments or outstanding debt the credit card recipient racks up — and nearly 40 percent of cosigners told CreditCards.com they lost money on the deal; 28 percent had their credit damaged; and 26 percent said their relationship with the person they were signing for suffered.