If you’re committed to the frugal life, there are certain things you just can’t afford to do. Unfortunately, it’s hard to avoid falling into all kinds of sneaky marketing ploys, subscription traps, and discounted items that are hardly discounted at all. Redditors shared some of the top frugal sins in this thread, and now we’re on the lookout for more ways we’re making major mistakes with our money.

1. Renting a Storage Unit — Only To Forget About It

The costs associated with maintaining access to your own storage unit can sneak up on you in a terrible way. If you don’t keep a watchful eye over your unit’s monthly cost, you could find yourself in a situation where you’re paying upwards of three times what you used to. Even if the cost of your storage unit remains steady, a smarter move might be to donate or sell your extra stuff for more money back in your pocket.

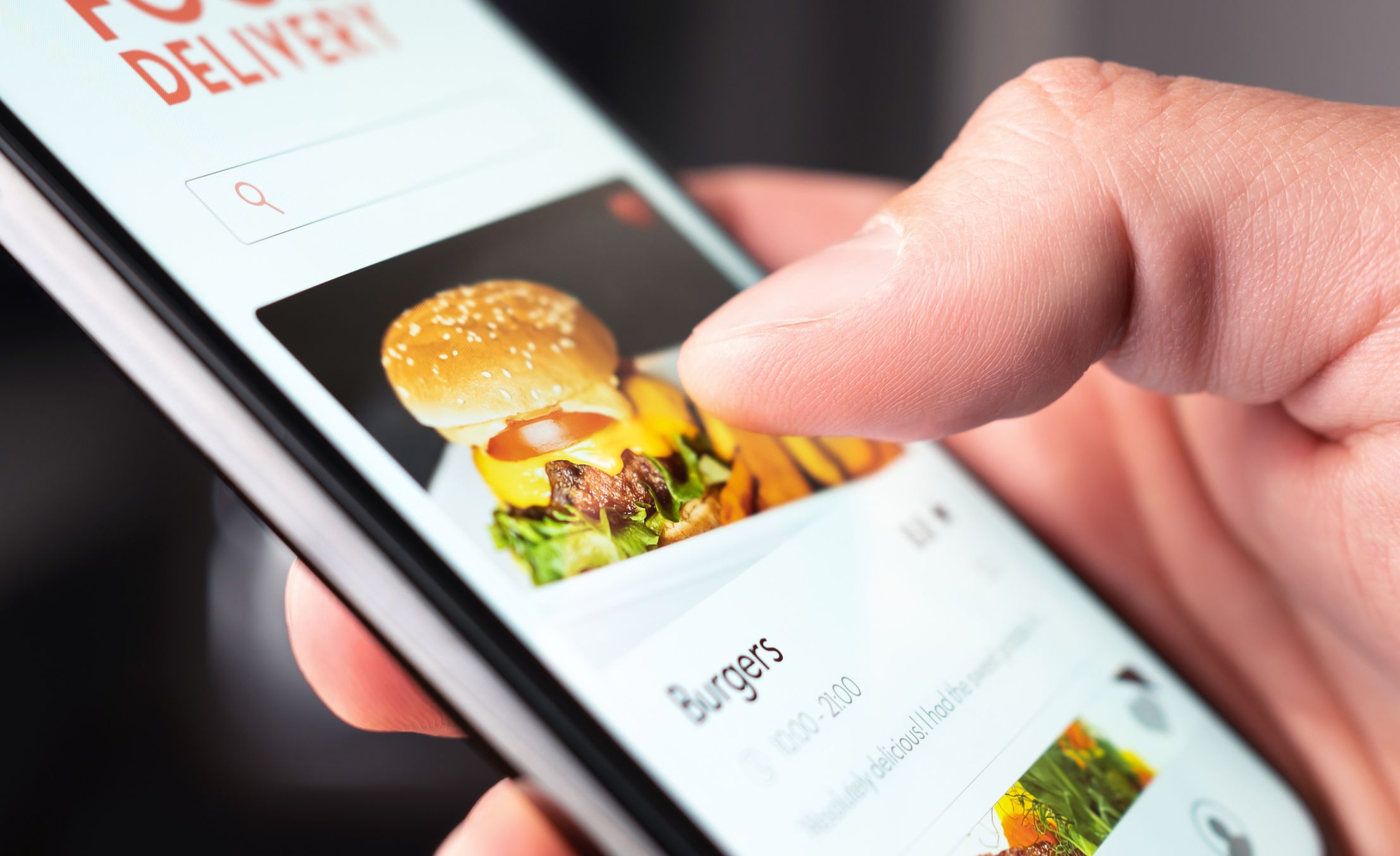

2. Using any Delivery App

Sure, we all have our off days. Maybe you woke up with a terrible cold, and the only thing that sounds good is soup delivered by Uber Eats or Grubhub. Getting food delivered should be a rare exception, though: Food delivery apps can cause a major dent in your financial health.

3. ‘Buy Now, Pay Later’ Online Purchases

There are plenty of stores that offer “buy now, pay later” plans, but that doesn’t mean you should use ’em. If you’re unable to pay the balance off by the end of the month, you are setting your future self up for stressful times. Interest rates can creep up and pounce on you, and before you know it, you’ve dug yourself a hole that you will have a very hard time finding a way out of.

Related: 32 Credit Card Mistakes You’re Probably Making

4. Financing a New Car That’s Beyond Your Means

Just don’t do it. Yes, a shiny new car is one of the ultimate ways to treat yourself. Maybe the unprecedented quarterly bonus hit your bank account, and you’ve achieved new heights of financial success. Slow down, though. Instead, pivot into investing that money, or even just continue building up your emergency fund. The monthly payments on fancy new cars can blindside you and really aren’t worth it.

Related: 11 Things You Need to Know Before Leasing a Brand New Car

5. Booking Separate Flights With a Tight Connection

Related: What Flight Attendants Want You To Know About Flying Now

Trending on Cheapism

6. Scratch-Off Tickets

This one falls comfortably under the umbrella of “frugal common sense.” Scratch-off tickets can seem harmless enough; for a few bucks, you can try your chance at winning free money for life. But the odds of you actually winning are pretty much non-existent. If you need a reminder, look for the odds that are often printed on the tickets themselves for a glaring reality check.

Related: Why You Should Never Play the Lottery

7. Adjustable-Rate Mortgages

Those higher mortgage rates could end up being your worst nightmare. And if you need any more info on what that can look like, just remember the time that the housing market caved in on itself in 2008.

8. Not Adjusting the Thermostat When You’re Gone

I get it. Nobody likes to suffer through the harsh cold of a bone-chilling winter or the heat of the summer inside their home. However, utility bills can throw your financial health in harm’s way very quickly. Remember to adjust your thermostat when you’re not at home — you can even leave sticky note reminders until it becomes second nature.