Holiday shopping is starting to feel a little like ordering a burger and getting … the bun. With inflation humming, tariffs climbing, and retailers testing our patience, Americans are spending more than ever, yet walking out of the store with lighter bags and heavier bills. Black Friday proved it, and Cyber Monday sent us over the edge.

Sales Look Strong — Until You Look Closer

Retailers cheered over “solid” numbers. Mastercard saw a 4.1% boost in sales on Black Friday. Online sales jumped 9% according to Adobe Analytics, and shoppers spent a total of $14.25 billion on Cyber Monday (a 7.1% year-over-year increase). The headlines look great on paper. But if you’re reading those headlines and thinking, “How on Earth are people buying that much stuff?” while you check your bank account balance with bated breath, keep in mind: They’re not getting that much stuff after all.

Instead, Salesforce reported that those head-scratching figures were driven by a 7% jump in the average selling price. Suddenly, it all makes sense. Factor in order volume, which also declined 1% over last year, and the fact that units per transaction on Black Friday were down by 2%, and gravity pulls you back down to wrap your head around the figures.

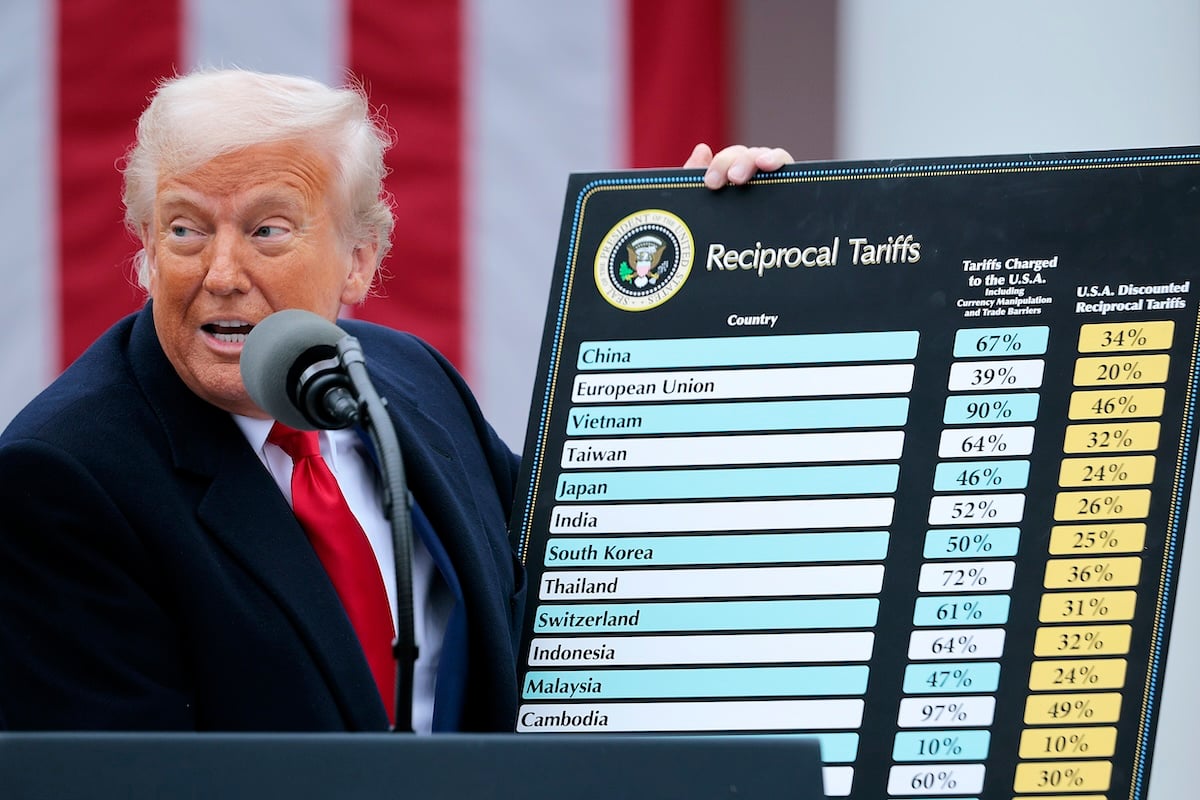

Tariffs, Tariffs, Tariffs

We said it three times. If we say it three more, will they suddenly go away like Beetlejuice? Tariffs, tariffs, tariffs! Bah. A big chunk of the price hikes ties back to new tariffs. Imports are more expensive now and at levels we haven’t seen since the 1930s.

Furniture saw the biggest spike; prices jumped roughly a quarter since last year. Clothing and electronics followed. All of those rely heavily on imports. When the cost goes up overseas, it hits your cart at home. And yes — this is exactly the part where you realize that waiting all year for “60% off” doesn’t mean anything when the starting price has ballooned by 24%.

The K-Shaped Holidays

The divide between shoppers keeps growing. Higher-income households came in hot. They filled carts. They clicked “Buy Now.” They leaned into luxury and home goods. Lower- and middle-income families, on the other hand, trimmed their budgets hard. Many planned to cut gift spending before the season even started. Rising unemployment, stubborn prices, and flat wages forced a lot of families to make choices that don’t feel festive at all.

The Only Thing Consumers Trust Now Is a Discount

People didn’t buy early. They waited. They stalled. They basically told retailers: “Do better.” And retailers folded.

Once the discounts got deep enough, shoppers finally jumped back in. Order volume turned positive only after markdowns grew more aggressive. That’s the new game: Americans will spend, but not without a fight. Just don’t do what I did and put something in your cart on Cyber Monday and forget to check out until Tuesday morning. Holding out is only effective when you follow through, folks.

One thing’s certain: If you feel like you’re paying more and getting less this holiday season, you’re not imagining it. You’re just living in 2025.

Find Similar Stories on Cheapism

- Trump Tariffs Threaten to Add $132 to Every Holiday Shopper’s Expenses, Study Says — Holiday shopping will only get worse this year.

- Costco Shoppers Can Expect New Kirkland Signature Thanks to Tariffs — Costco is not about to let tariffs mess with your grocery bill.

- The Bath & Body Works Candle Day Sale Drops This Week, and Fans are Prepared for the Craziness — It’s the most wonderful time of the year.