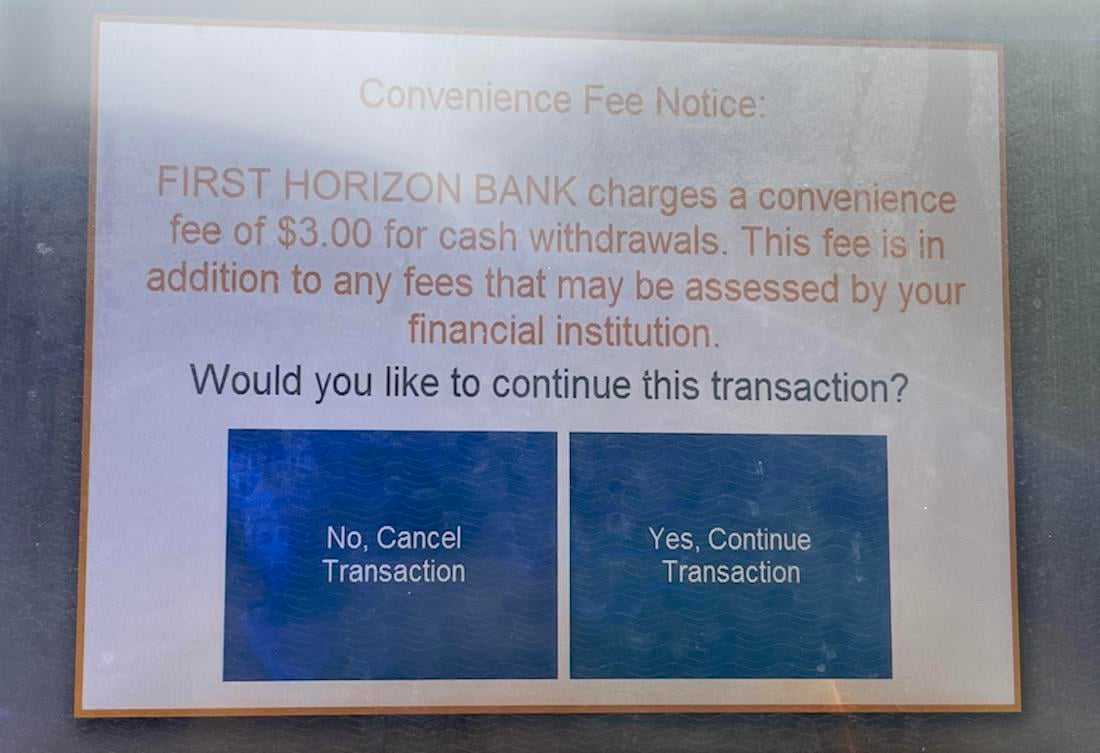

If it seems like everyone is trying to nickel and dime you, that’s because it’s true. One particularly annoying example? ATM fees, which hit a record high average of $4.86 this year.

With a little forethought, there are ways to avoid paying a fee every time you take out money from an ATM — and those couple dollar fees really add up over time. In emergencies, you might not be able to avoid the charge, but you can dodge it under normal circumstances. Here’s how.

Use In-Network ATMs

Each bank is part of a network of ATMs. If you withdraw money from an ATM that’s in your bank’s network, they won’t charge you a fee. This is the easiest and more foolproof way of avoiding paying that money.

When you sign up for a checking account, pay attention to the bank’s ATM network. If there’s not many in the city you live in, you’re probably more likely to incur fees. Some banks have larger networks than others, so if you find yourself withdrawing money often, go with the bank that has the bigger network if possible. AllPoint and MoneyPass are two of the largest ATM networks that banks can partner with. Many even have mobile apps that help you find the nearest in-network ATM.

Get Cash Back From Debit Purchases

Instead of heading to the ATM, make a beeline for a grocery store or pharmacy. Purchase something that you’ll use, even if it’s just a bottle of water or some gum (bonus points if you need anything from the store you’re at!), and choose to receive cash back when you checkout. The store will give you cash for the amount you request. But keep in mind that you generally have lower limits on the withdrawal amount compared to an ATM.

Get a Bank Account That Reimburses ATM Fees

Some banks actually take pity on you for having to pay out-of-network ATM fees, believe it or not. They’ll reimburse you for the fees up to a certain amount. Ally Bank, Charles Schwab, and TD Bank are just a few of the banks that do, so make sure you ask before signing up for an account.

Ditch Cash Altogether

This isn’t the most satisfying strategy, but if you stop carrying and using cash, you won’t be incurring ATM fees. It’s easier now more than ever to go cash-free, and lots of events, venues, and restaurants are already cash free anyway. While it may take some getting used to, once you ditch cash, you’ll never go back.

Use a Payment App

Even if you don’t have cash on you, chances are you’ll have your smartphone, right? Many retailers and service providers accept digital credit cards and other digital ways of paying, like Apple Pay or Zelle. So if you find yourself without cash, see if you can pay digitally instead of hitting up the nearest expensive ATM.

Trending on Cheapism

Plan Ahead

Sure, “plan ahead” is always good advice, but it’s especially true for avoiding crazy ATM fees. That’s because fees are always higher in certain places, from music festivals to amusement parks to popular bars. If you’re going to any place that’s touristy or is an event that charges admission, you’re just asking for ridiculous fees if you use the ATM there. Plan ahead and bring more cash than you think you’ll need — preferably cash that you got from an in-network ATM.