For some, renting is seen as throwing money away. Think about it: You pay rent every month for a property you will never own and as long as you’re renting, that monthly payment will never go away. Mortgage payments, on the other hand, are often viewed as working toward something — you make your payment every month and eventually the home will be yours and you won’t have to pay a lender anymore. Despite the obvious benefits and logic, a surprising number of higher-earning Americans are now opting to rent, according to a recent report.

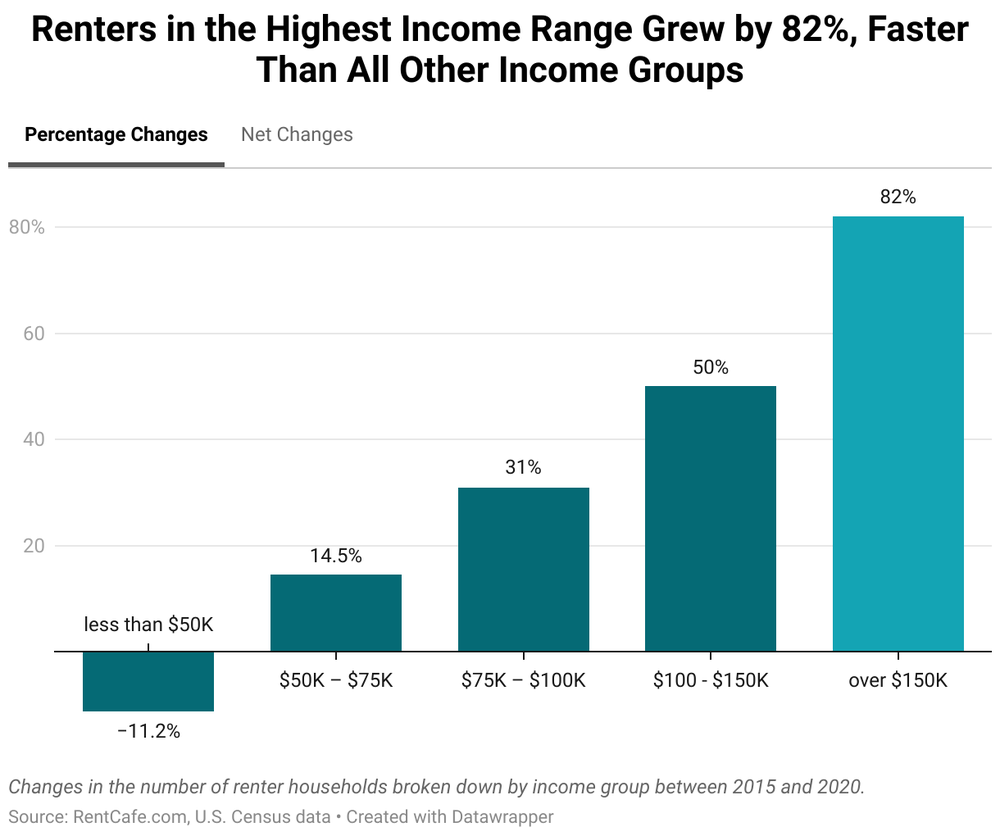

According to the most recent U.S. Census Bureau data, the homeownership rate is currently at 65.9%. RentCafe analyzed the Census Bureau’s data and discovered that around 43 million families live in apartments, the highest renting level in nearly 50 years. But lower-income families aren’t the only ones putting off buying. Between 2015 and 2020, the number of renters making more than $150,000 a year grew by a staggering 82%, while the number of millionaires who rent has tripled. There are now 2.6 million high-earners renting in the U.S. and renter households with incomes exceeding $1 million reached a record high of 3,381 in 2020.

Gallery: The Top U.S. Cities for Renting vs. Buying

While it might seem these wealthier renters are throwing away money, their reasons could be rooted in mortgage rates. For a $400,000 mortgage with the current average interest rate of 6.42%, buyers can expect to pay about $2,507 per month on a 30-year fixed loan, according to Google’s mortgage calculator. In 2021, when the average mortgage rate was 2.65%, homeowners who purchased a $400,000 home with a 30-year fixed-term paid $1,612 each month. Yes, you’re reading that right — in two years, the rate hikes have resulted in monthly payments of nearly $1,000 extra, which could very well be why high-earning individuals are holding out for lower rates.

For more stories about real estate trends, please sign up for our free newsletters.