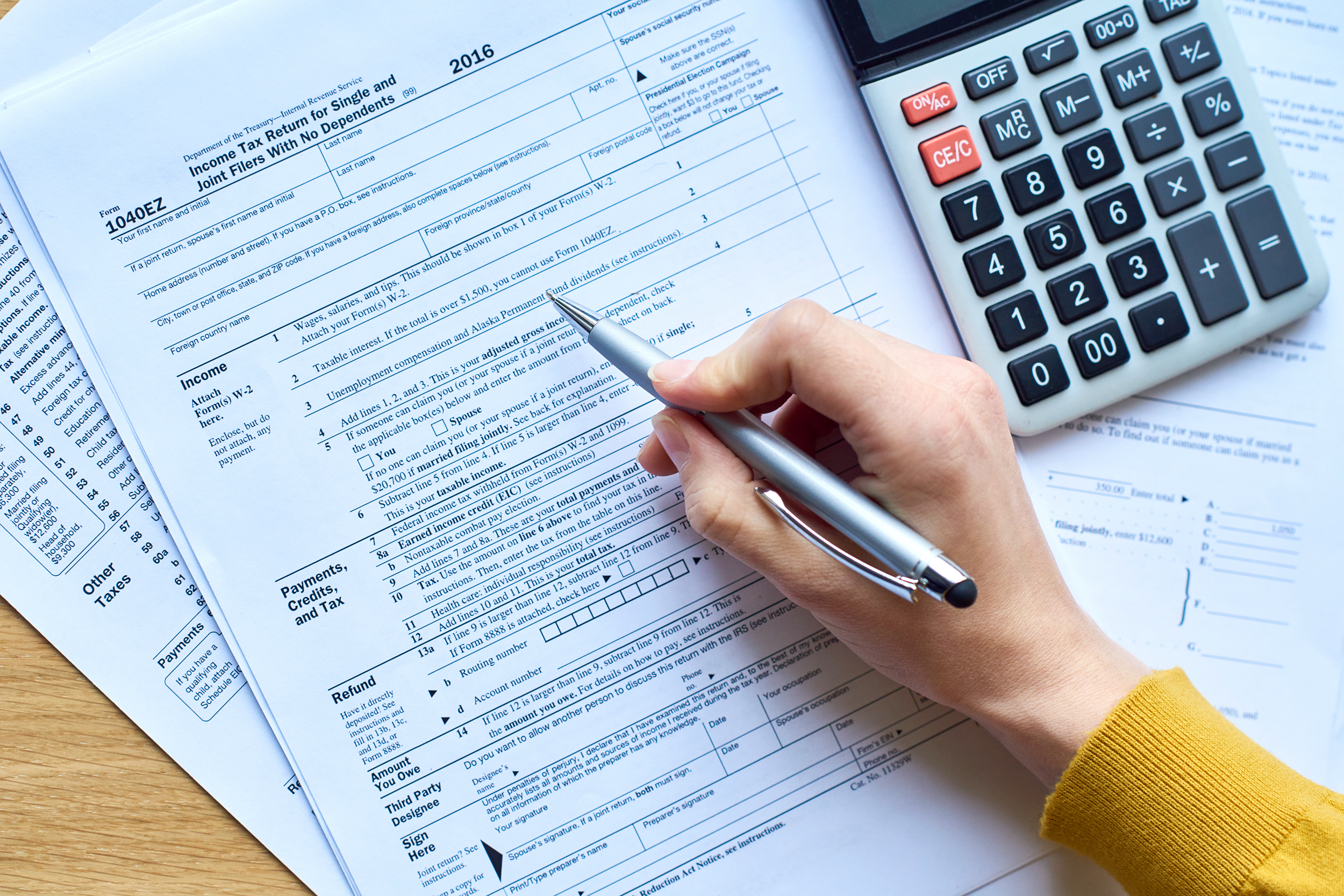

The federal budget for the 2020 fiscal year (that us, Oct. 1, 2019, to Sept. 30, 2020) is about $4.6 trillion, according to the Congressional Budget Office — which requires quite a bit of borrowing, considering tax revenue for the year is projected to be only $3.7 trillion. Almost exactly half of that comes from federal income taxes; around one-third comes from payroll taxes; 7% comes from corporate taxes; 4% from excise taxes (such as the gas tax); 2% as a result of earnings from Federal Reserves holdings; and estate taxes and other miscellaneous taxes make up the remaining 2%. It’s a hefty chunk of change.

To help put those numbers in perspective, we wanted to find out: If someone paid a total $1,000 in taxes this year (including Social Security and Medicare taxes), where would it all go? For those wondering how federal tax dollars are spent, here’s a breakdown. You might notice that the final tally equals $1,060. That’s because the Congressional Budget Office includes $274 billion (about $60 out of $1,000) in “offsetting receipts,” which is revenue the government earns from other government agencies.

Related: 10 Things to Do Now to Lower Next Year’s Tax Bill

A Brief History of Tax Revenue

Tax revenue tends to increase every year, thanks to inflation and population growth, but during the most recent recession starting in 2008, tax receipts actually decreased and didn’t get back above 2007 numbers until 2013. The first year tax revenue reached 13 figures was 1990, when the government collected $1.03 trillion. That’s roughly the same as the $1.1 trillion in tax revenue the federal government collected between 1789-1959 combined.

Where Does it All Go?

The vast majority of the nearly $5 trillion the government will spend this year, or about 60%, is earmarked for mandatory spending, or $620 out of your $1,000. That’s made up mostly of big, expensive, legislatively mandated social programs such as Medicare, Medicaid, and Social Security. Then there’s discretionary spending, the part of the budget appropriated by Congress, which accounts for about 30% of federal spending. That’s $300 out of your hypothetical $1,000 in tax money that pays for things such as the military and the Department of Veterans Affairs. Finally, a little less than 10% of federal tax revenue goes to covering interest payments on the soaring national debt, which is the fastest-growing federal expense.

Social Security

How Much of Your $1,000: $240 No expenditure costs more than Social Security, which is paid for through payroll taxes as part of the government’s mandatory spending obligations. The Social Security Act of 1935 guaranteed income to all retirees after their earning years have passed. A little over $1 trillion is slated for Social Security spending in fiscal year 2020.

Medicare

How Much of Your $1,000: $179 The next biggest chunk of change goes to Medicare, another crucial part of the safety net that subsidizes the cost of health care for Americans over the age of 65. Medicare Part A covers hospital insurance, while Medicare Part B covers supplementary medical insurance. In fiscal year 2020, the tally for that expenditure comes out to about $821 billion.

Medicaid

How Much of Your $1,000: $92 The third major component of the country’s social safety net and of the federal government’s mandatory spending obligations is Medicaid, which provides access to health care for 64.7 million low-income Americans. Although the program is administered by the states, it’s paid for with a combination of state and federal tax dollars. This year Medicaid spending will come in at $420 billion.

Trending on Cheapism

Mandatory Spending: Beyond the Big 3

How Much of Your $1,000: $167 Once the three central safety net programs are paid for, the federal government still has about $765 billion in mandatory spending obligations. Most of this goes to income subsidization programs such as housing assistance, child-tax credits, child nutrition programs, and food stamps. Other mandatory spending includes things such as unemployment benefits, disability, and retirement payments for federal employees, the Affordable Care Act, and the Economic Stimulus Act of 2009.

The Military

How Much of Your $1,000: $141 About 27% of the budget — $1.3 trillion — will go to discretionary spending, the only federal spending Congress can raise or cut through appropriations. About half of this year’s discretionary spending budget will go to military spending. That’s $648 billion in tax money sent to D.C. — for the Department of Defense and defense-supporting departments and agencies such as the VA, the State Department, the National Nuclear Security Administration, and the FBI.

Related: The Biggest U.S. Military Site in Every State

Other Discretionary Spending

How Much of Your $1,000: $141 Since roughly half of all discretionary spending goes to the military, the other half — about $647 billion — has to pay for everything else. The biggest portion of that goes to America’s largest domestic agencies, including the Department of Health and Human Services, the Department of Education, the Department of Transportation, and the Department of Housing and Urban Development.

Related: What Does It Cost to Send a Kid Back to School?

Sign up for our newsletter

Interest on the National Debt

How Much of Your $1,000: $100 Roughly 10% of federal tax revenue, or about $460 billion, will be spent satisfying the interest accumulated on America’s national debt, which grows every time the country spends more than it generates in tax revenue. This year, that gap is around $1.1 trillion, and the total national debt is about $23.3 trillion and counting.