No matter how you look at it, raising kids can be expensive. According to recent studies, the average cost of raising a child from birth to the age of 17 is $310,605, which covers food, shelter, and other essential necessities. Beyond that, there are many things parents are tempted to buy for their kids, and a lot of it is a waste of money in the long run. Here’s a look at how parents waste money on kids when they could be saving more money for retirement or their kids’ college education.

Baby Gear

Forget new gear for each baby. Hand down what you used for baby one to baby two. If it’s your first time, consider shopping at consignment stores. As long as it’s safe and up to code, you can easily find a used stroller, crib, carrier, pack n’ play, high chair, and other items for less than new versions.

Brand-Name Clothes

Instead of ordering those brand-new, brand-name boots for your daughter or son this year, hit up a big box retailer, a garage sale, or a second-hand store. You’ll likely find something equally cute, or you might even hit the jackpot and find brand names for a fraction of the price. Ditto on all the brand-name athletic clothes. Remember, there is no shame in passing down clothes from child to child or accepting hand-me-downs.

Kid-Marketed Products

Ever wonder how your kids can spot the “Star Wars” bandages, SpongeBob bath bubbles, or Elsa’s “Frozen” toothpaste from a mile away? These products are marketed directly to them and even placed at their eye level in the stores. Why pay more for “My Little Pony” bandages when plain ones work just as well?

New Bikes

What kid doesn’t love a new bike from Santa? But the truth is that just as quickly as kids outgrow clothes, they outgrow bikes, roller skates, skateboards, and the like. Buying those things new is a surefire way to waste money on your kids. Instead, consider local consignment shops or find a bike at a garage sale and give it a thorough cleaning. Your kid won’t know the difference.

Electronics, Apps, and Video Games

Electronics and technology are a way of life for the up-and-coming generations, and they’re not going away (even if you wish they would). While some technology is great and even essential for learning, proceed with caution. Apps that start as free almost always have a paid version, along with in-app add-ons. Video games can also be expensive, and your child will likely want the next best thing in a week or will tire of the game faster than you can blink. Solution: If your child wants apps and video games, have them use their own money to buy them.

Trending on Cheapism

Impulse Buys

Have you ever taken a kid into Target and left wondering how you spent over $100? Those little accessories and toys that your kid begs for in every aisle really do add up. Just say no, or better yet, hit up those stores without the kiddos in tow.

Birthday Parties

Your 3-year-old doesn’t need an extravagant birthday party. One celebration, cake, and a small gift will suffice. There’s also no need to schedule multiple parties, such as one at school, one with each side of the family, and a friends-only party. Also, skip the party favors (or at least buy them cheaply). They are usually junk that the kids don’t really care about anyway.

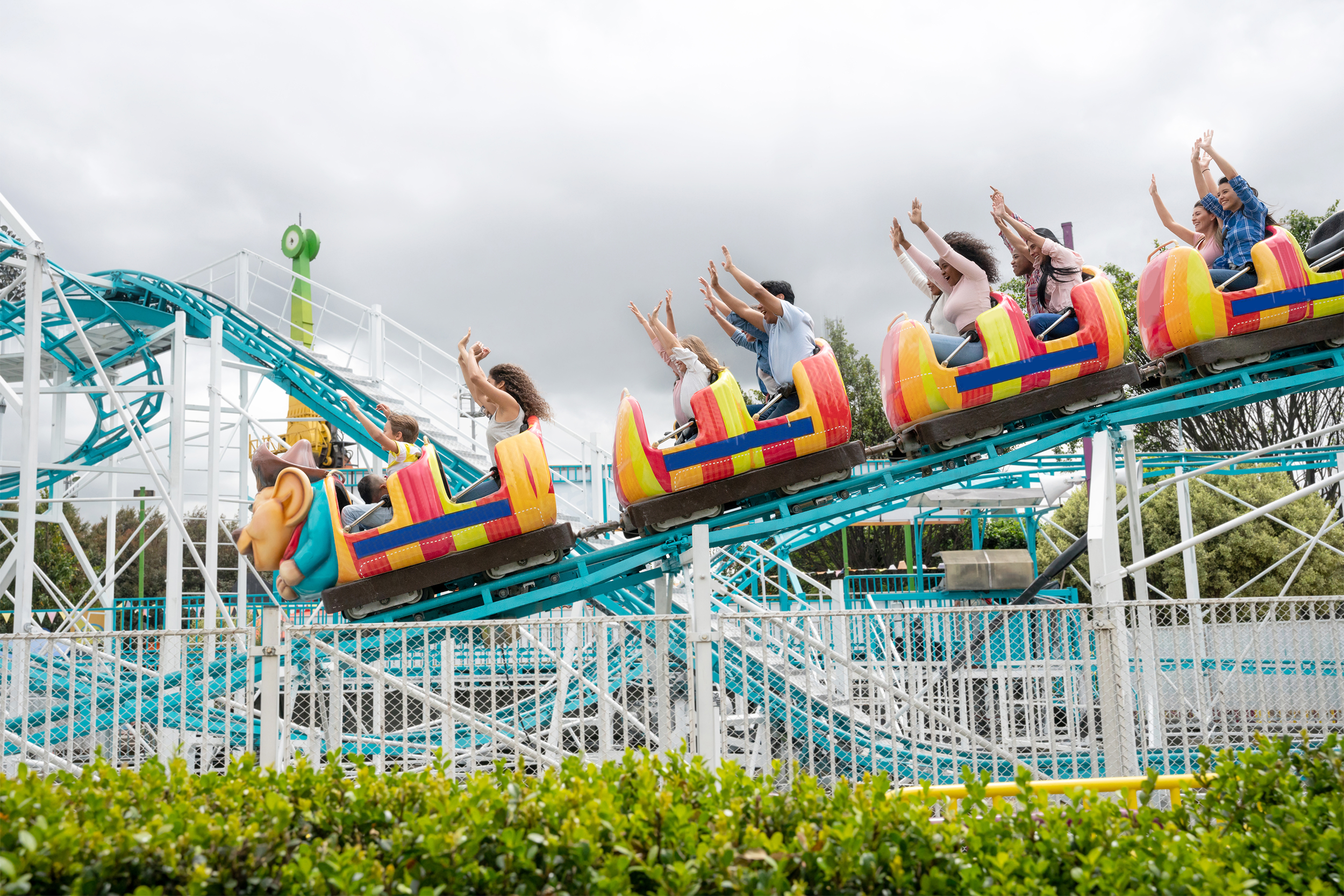

Family Passes

In theory, having a family pass to the local zoo or the nearest theme park sounds like a great idea, but be realistic about how often you can actually make an outing happen. A good rule of thumb is that if you really think you’ll visit at least once a month, then go for it. Otherwise, pass on the family pass.

Sign up for our newsletter

Pets

The family dog is one thing, but a hamster, a fish, a snake, and all the other little critters your kids decide they must have can start off as being cheap pets but just end up as money pits. A hamster requires a cage, cedar shavings, food, toys, and more, but will it live long enough to enjoy all its amenities? Even if it does, your kids could lose interest within weeks — leaving you stuck to take care of it and provide for it.

Eating Out

Eating out with kids is rarely enjoyable. Kids seldom behave in restaurant settings, and you’ll spend a small fortune on food they will barely touch. Eating out as a family, as nice as it may sound in theory, just isn’t worth it. Stay home, cook what you know your kids will eat, and reserve eating out for date nights without the kids. And if you are going to eat out with the kids, consider opting for restaurants where kids eat free.

Backyard Entertainment

Are your kids begging for a backyard pool, a trampoline, or a basketball hoop? In some cases, these purchases make sense, but you must ensure they are genuinely worth the investment. Is basketball a passing hobby? Will the trampoline cause your home insurance to skyrocket and hardly get used? Will that pool be forgotten as soon as your kids decide the local swimming hole is more fun? These are just a few considerations to keep in mind when contemplating a significant purchase that could result in a lot of wasted money.

Brand-Name Schools

College is a great investment in your child’s future, but the price tag shouldn’t cripple your retirement or your child’s future financial health (and in some cases can be cheap or even free). Figure out what you can comfortably contribute and let your child know the limits. If your child still desires a brand-name school, make it clear that they will be responsible for the difference. It’s also fair to help your child choose schools that align with their future goals, rather than just selecting schools based on name recognition.

Extravagant Weddings

According to The Knot, the average cost of getting married in the United States is $33,000. That figure doesn’t even cover the cost of a honeymoon. As everyone found out during the pandemic, when weddings were either put on hold or scaled back significantly, a wedding can be done on a much smaller budget. You need to figure out what you can comfortably contribute and be candid about it with your child. If they want to spend beyond that, it will be their financial responsibility.

Keeping Up With the Joneses

Learn to let go of competitive parenting by not striving to have your kids be the best dressed on the playground or have the best electronics. Your child will learn to care less about what others have if you aren’t similarly swayed. While it can be humbling, it is also freeing financially and a great way to teach your kids about money.

More Smart Money Tips From Cheapism

- 50+ Things You Absolutely Never Need to Buy — Useless purchases come in many forms. Here are some you’re better off without.

- 10 Ways You’re Likely Wasting Money — and Will Regret It Later — If you’ve ever looked at your bank account and thought, Why did I buy that? — there’s probably a mood behind it.

- 10 Tips for Saving Money With the “No-Buy” Challenge — Although it sounds like a hardship you may not wish upon your worst enemy, the trending challenge could save you a ton of money.