There are the usual things you can do to save money — clip coupons, eat out less, buy items on sale — or not at all. But someone asked Reddit for money-saving life hacks and some might surprise you enough to add them to your to-do list.

1. Follow the 72-Hour Rule

This one seems simple enough — just wait a few days before you buy. Given how easy it has become to just swipe or press a button to snap up the latest trendy item on Amazon, taking a breath can be a huge budget saver. If you’ve forgotten what you wanted after the time is up, it wasn’t important to buy (even on sale) anyway.

2. Buy Reusable Items

While it can cost more in the short term, investing in reusable items such as washable towels over paper, steel water bottles over plastic, and other items will pay off. Says one Redditor: “It’s better for your wallet and environment. Steel water bottles, reusable K cups, dish towels instead of paper towels, etc. Over time the costs of little things really add up.”

3. Don’t Buy Because of Coupons

Before you clip a coupon, ask yourself if the item is something you’d buy anyway. If you’re only using the coupon to “save” money, it’s not doing yourself any favors.

4. Buy Full Price (If You Have to)

Don’t think you’re saving money by getting a discounted item that isn’t exactly what you want. Chances are good you won’t use it and may end up buying what you really want later. “I’d rather pay full price for an item when I’m sure I want it, than buy on a discount on the hopes i’ll want it someday,” said one Redditor. “Funny enough, that is quite cost effective. I can’t tell you the number of hard drives I have avoided buying with that strategy.”

5. Look for the Price Per Ounce

When trying to decide between items like dishwasher soap or frozen food, it might be worth checking out the price per item or ounce on the listed price. It could make it easier to decide between similar items that come in different sizes — and help you save money.

Trending on Cheapism

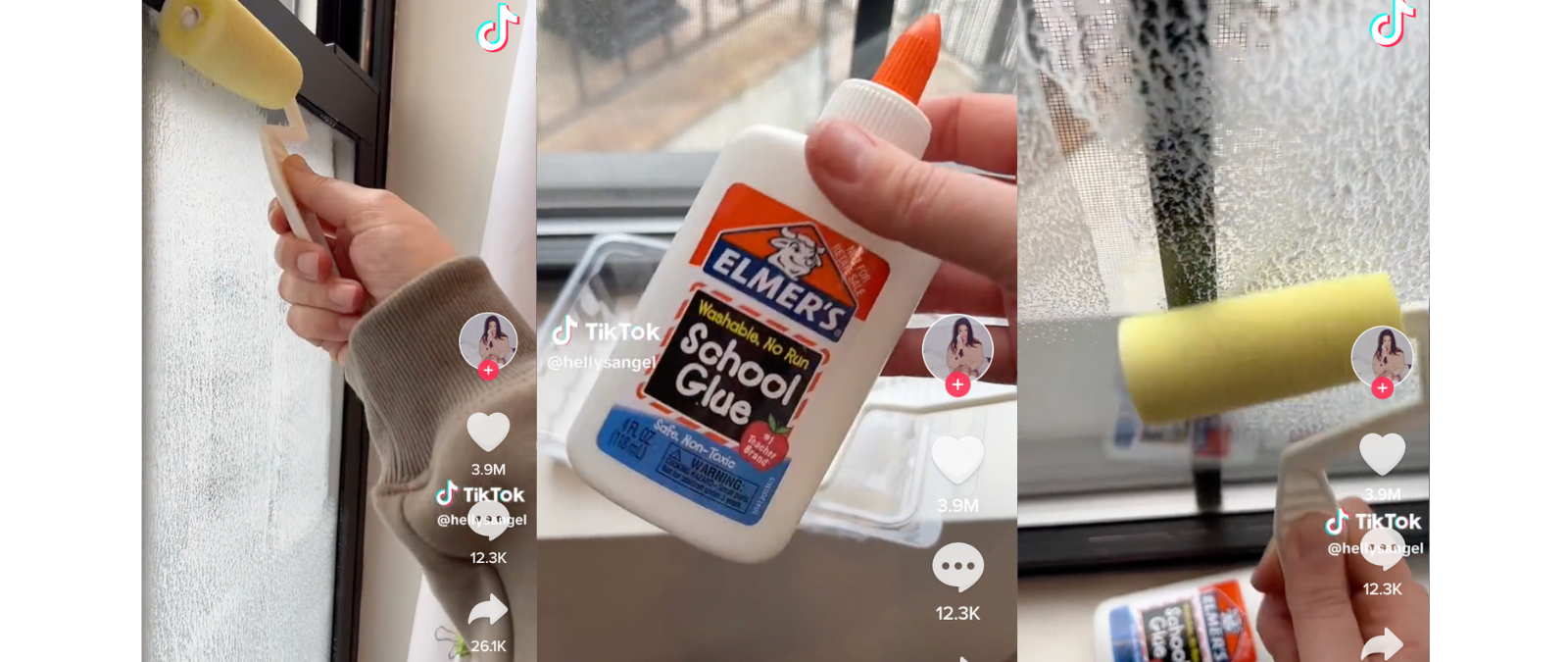

6. Pay for Your DIY Repair

If you’re unsure about investing in a tool to repair an item you might otherwise take to a vendor to fix, ask yourself if you’re likely to have to fix this again (if it’s clothes or electronics, there’s a good chance). If the tool costs the same as hiring someone else to make the fix, go ahead and buy it — the next time it breaks or tears, the repair (beyond the price of your time) is free.

7. Eat Before You Shop

This is a basic one, but make sure you have a full stomach before you hit the grocery store. You’re less likely to snap up junk food and you’re also not as tempted to buy everything that’s not nailed down.

8. Drink Water When You Eat Out

While it can be tempting to grab a soda or a cocktail, the restaurant makes its highest profits on beverage service — which is coming out of your wallet. Water is just as refreshing, and unless you order something fizzy, totally free.

Sign up for our newsletter

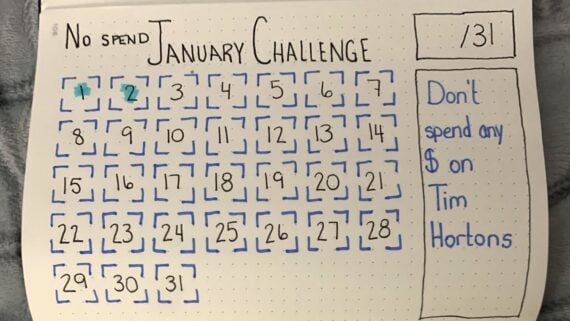

9. Forget Starbucks

Seriously, a coffee addiction adds up fast — fast enough that you can probably get a great espresso maker for what you spend on lattes in less than a year. Go ahead, drink up — but make your coffee at home. Want the latest frou-frou drink? Look for recipes online and pick up whipped cream or syrups at the store.

10. Check Your Balance

If you haven’t learned how to check your banking balance online, do it. Careful monitoring will make you aware of all your unnecessary purchases — and help you stick to a budget, too.

11. Roundup Your Spending

There are banks such as Bank of America, SoFi, Central Bank and Commerce Bank that allow you to round up purchases so that you add a little extra to a savings account throughout the month. If you struggle to put anything into your savings account, this is one way where you may not even notice how much you’re squirreling away.

12. Save First

One Redditor recommends saving money first (if you can), then worrying about other expenses after. If you plan on getting your savings squared up right away, it should make the rest of your month (hopefully) less stressful. If you wait until the end of the month, you might find there’s nothing left to save.

13. Avoid Payday Loans

If you want to dig a hole for yourself, payday loans are the way to go — so skip them entirely if you can. The interest on every loan can add up and reduce what you get dramatically when payday finally does roll around. These are one step removed from a scam, so spare yourself.

14. Save What You’d Smoke

This is a surprising trick to save money. Even if you don’t smoke, save the money you would theoretically spend on cigarettes each month. As one Redditor puts it, “Every Monday I transfer the sum of one weeks worth of cigarettes to my savings account. If people that earn less than me can afford smoking, so can I.”

15. Get a Library Card

While you can still get books at the library, there’s a lot more at most of them. In addition to movies and audio books, some also offer workshops, video games, access to crafting tools and even 3-D printers, computer time, and music. Before you spend on entertainment or even education, check your library first.

16. Grow Your Own Food

If you’re okay with digging in the dirt a bit, consider growing your own food. If you plant things you like, you can save hundreds of dollars each year — and depending on what you plant, the fruit or vegetable might come back with no effort on your part. If you have kids, get them involved — they’re much more likely to eat their vegetables when they’ve grown them themselves.

17. Buy Store Brands

Generic doesn’t have to mean so-so. Buying a store brand can mean getting the same product (or a very similar one) as the expensive one you usually buy. As one Redditor says, “Make it a game to find out who has what national name product as their store brand product.”

18. Learn to Cook

Step away from the takeout — even if you’re tired, a few reliable recipes can be whipped up quickly for far less than what you would spend on fast-food (which likely isn’t as healthy). Even a few pricey ingredients will still keep the balance in your favor.

19. Bring Your Lunch to Work

If you have to check into an office daily, take some time before you go to make something you’ll want to eat for lunch. You’re less likely to be pulled to a restaurant by your co-workers if you have something tasty in the office fridge.

20. Get the Middle-Priced Option

Play Goldilocks when checking out competing products. The cheapest one may underperform, but the most expensive is too pricey, so the one in the middle may be what you want.

21. Make an Extra Mortgage Payment

It’s hard to believe, but just one extra mortgage payment per year can cut a 30-year-mortgage to just 17 years. Retirement may be a lot more affordable, too.

22. Don’t Drink

Think a beer or two is no big deal? Maybe, but if you’re trying to save, bypassing booze might be the way to go. Not only is it expensive (especially if you’re bellying up to a bar and getting craft cocktails), you’re more likely to spend more money when after you’ve had a few.

23. Stay in Shape

In addition to improving yout looks, staying fit is a good way to stave off certain diseases, such as diabetes, heart disease, and some forms of cancer. Even if you have insurance, you’ll take a hit to the wallet if you get any of these ailments.

24. Drive Slower

While we’re always in a rush, it may be to your advantage to cool off a bit. According to one Redditor, driving a little slower can mean higher miles per gallon, less tire wear, and your engine might live longer, too.

25. Check Your Insurance Rates

You might think you’re getting a great deal, but it pays to call around and compare. One Redditor found out he’d been paying 2.5 times what he could have been for car insurance for more than a year, which added up to $1,500. A little time on the phone can be worth it.

26. Resole Your Shoes

If you spend money on a classic pair of shoes, and you still like them, go ahead and get them fixed when they wear out, As one Redditor put it, you avoid “the hell” of shoe shopping and save money, to boot.

27. Don’t Wash Your Hair So Much

It’s a myth that you need to wash your hair daily to fight oiliness — your scalp “responds [to overwashing] by increasing sebum production, leading to a cycle of ‘I have to wash my hair every day or it’ll be greasy,’” according to one Redditor. Slowly cut back and save money on shampoo and conditioner in the process.

For more budget-friendly tips, sign up for our free newsletters.