Money is a big source of stress — in fact, nearly three-fourths of respondents reported money worries in a 2014 survey by the American Psychological Association. If financial stress is getting to you, consider simplifying your life by implementing these 15 easy ways to streamline your spending and regain a sense of control.

SIGN UP FOR EBILLS AND ESTATEMENTS

Only 12 percent to 15 percent of bills and statements are delivered electronically, according to Forbes. Going paperless — using a password manager to make ebills and estatements easier to manage — will ultimately save time that would otherwise go to sorting documents. It helps the environment too.

SHRED LEFTOVER PAPER

Get rid of the useless mounds of old financial papers cluttering the house (and your mind). The Federal Trade Commission has a great list of what to keep, including important things such as Social Security cards, birth certificates, and tax returns. But those paid bills, receipts, old bank statements, and old pay stubs? Shred ’em to reduce the risk of identity theft.

AUTOMATE SAVINGS

It’s all too easy to forget to feed a savings account. Set up an automatic transfer between checking and savings accounts at certain intervals, or even funneling part of direct deposits into a savings account from the get-go. That way, your all-important emergency fund keeps growing, and you barely have to lift a finger.

CONSOLIDATE RETIREMENT ACCOUNTS

If you’ve collected a few 401(k)s from different employers, consolidate them to more easily manage the funds and save on fees. No new employer-sponsored plan? Consider rolling your funds into an IRA — most have low fees and a lot of investment options.

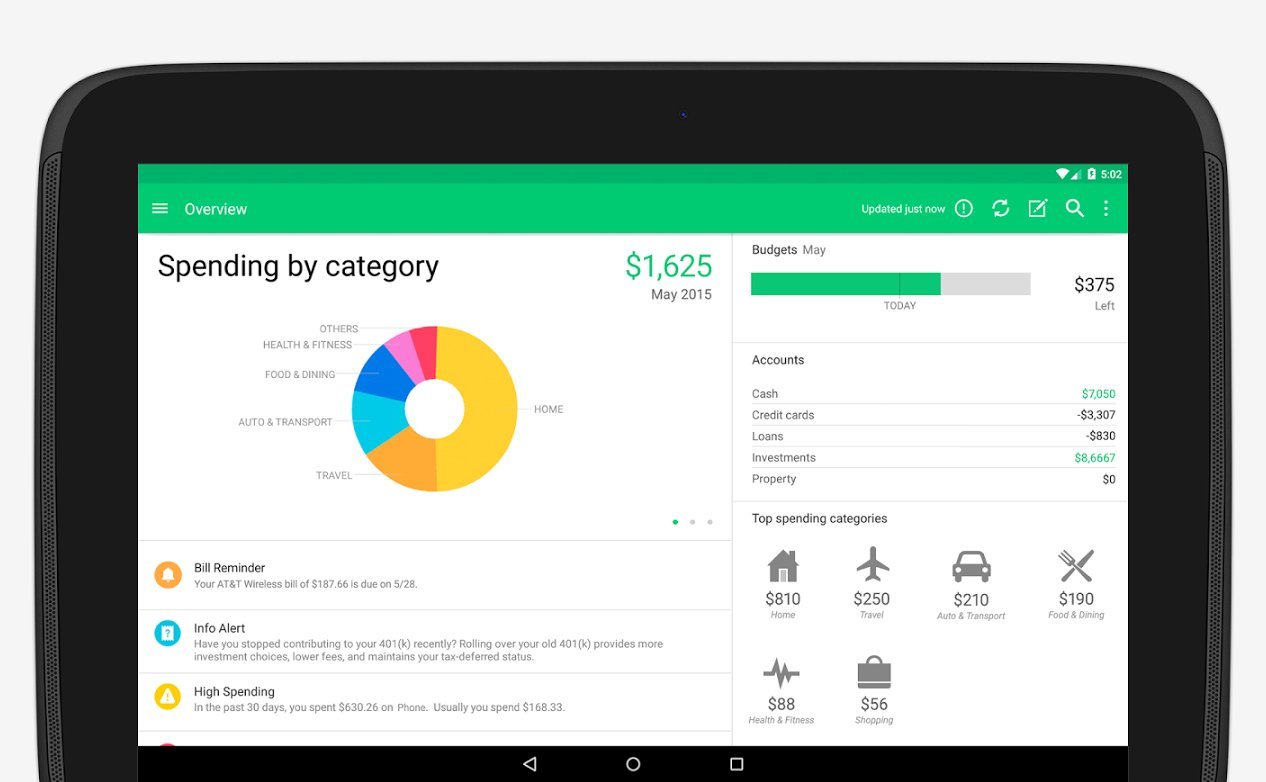

TRY A BUDGETING APP

Budgeting apps make it possible to log in to a single place to manage everything — deposits, withdrawals, investments, bills, savings, even overarching financial goals. Popular options include Mint, which is free but ad-supported, and You Need A Budget, which has a fee attached but helps users learn how to budget from the ground up.

Trending on Cheapism

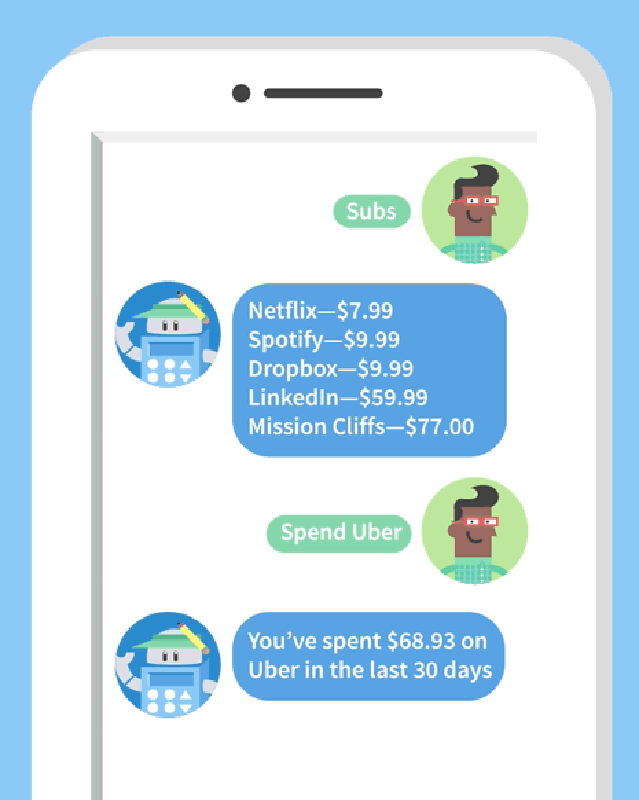

REVIEW PESKY RECURRING CHARGES

These days, it’s easier than ever to forget about subscription-based services that drain your accounts each month — perhaps you signed up for a gym you never use, a magazine you never read, or access to a music service you rarely listen to. A new app called Trim can cancel subscriptions you no longer need, doing the time-consuming dirty work for you.

USE CASH MORE OFTEN

Paying with cash simplifies a lot. There’s less chance of identity theft, there’s no need to remember to pay a bill later on, and it limits impulse buys — after all, when cash is gone, it’s gone. There’s also a psychological boost: Time details a study that shows people who pay with cash value their items more than those who pay with plastic.

THIN YOUR CREDIT CARD COLLECTION

If you’re carrying more plastic than you need, it may be time to close some accounts. But be strategic — canceling many cards at once can hurt your credit-utilization ratio (the credit you have vs. how much you use) and lower your credit score. Prioritize unused cards with annual fees, newer cards, or those with very unfavorable terms for cancellation. Old unused cards may be worth keeping because they help show a long credit history, which helps a credit score.

Sign up for our newsletter

USE JUST ONE BANK …

Tired of waiting on funds to transfer from bank to bank? Annoyed with remembering different log-ins, or waiting for different statements? Simplicity is the major advantage of parking your money in one place. One notable drawback: You may forgo a better savings interest rate, especially if you keep your money local, as most high-yield savings accounts are online.

… AND ONE INSURER, TOO

Chances are you’ve got multiple policies: home or renter’s insurance, car insurance, life insurance. Keeping them with one company makes things easier to manage, and you may be able to score a nice discount from bundling policies. But don’t just assume you’ll save — compare what you’re paying “a la carte” before making the switch.

PAY FOR PROFESSIONAL HELP

If finances are a major source of stress, why not pay for a little peace of mind? If you have a complicated tax situation, hire an accountant. If you’re not sure you’re on track with retirement savings, consult a financial planner. Or, for more budget-friendly guidance, NerdWallet recommends trying a robo-adviser.

REIN IN SPENDING …

Money is less of a hassle when you don’t spend as much of it. LearnVest especially cautions against buying things simply because they’re on sale and you’re getting “a deal”; the only consideration should be whether it’s actually needed, and whether you can afford it.

… OR AT LEAST SKIP SPENDING ON ‘THINGS’

It’s widely known now that we’re happier when we spend on experiences — vacations, concerts, classes — than tangible things. That’s because it’s easier to “adapt” to life with material things, while experiences become a deeper part of us, researchers say.

ASK FOR A LOWER INTEREST RATE

If credit card payments are a source of stress, one of the smartest, simplest moves is to simply ask for a lower interest rate. It’s cheaper for a credit card company to keep an old customer happy than to woo a new one. You’re most likely to be successful if you’ve had the card a long time with an unblemished payment history.

FINALLY GET THAT WILL

Remember, finances still need managing once you’re gone, so make sure you’re the one calling the shots — draw up a will now, especially if you have kids. While a professional is the best way to go, people in a budget crunch and with relatively straightforward finances can use online services that can guide them through the process fairly simply. AARP suggests using sites like Nolo, US Legal, or Legalzoom, or simply picking up forms at an office-supply store.