Italian pasta prices may soon go through the roof.

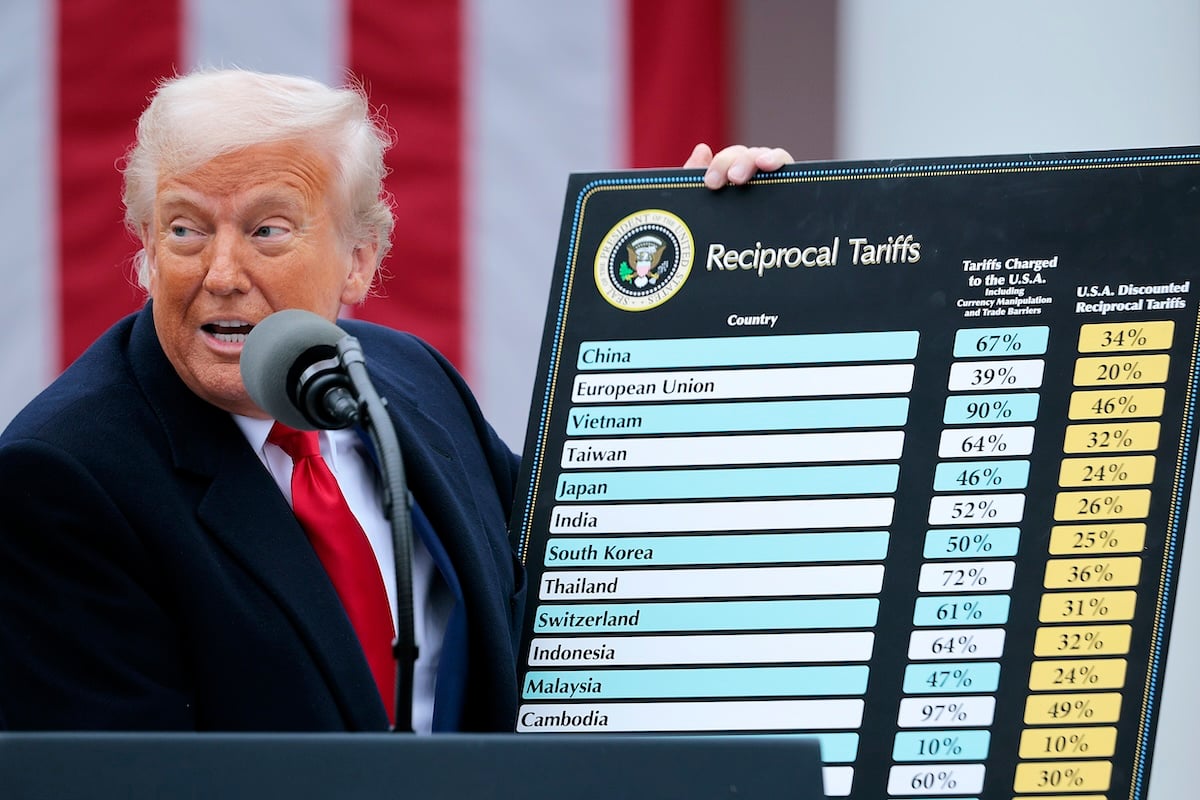

Beginning in January, a new tariff of 92% is set to go into effect on the 13 largest Italian pasta exporters, the result of a U.S. Commerce Department antidumping investigation that started last year. On top of the 15% tariff already in place on imports from the European Union, that equals a tariff rate of 107% starting next year.

What does that mean for your plate of spaghetti? Well, as you’ve probably figured out by now, you’re going to be paying for most of that cost increase. The tariffs would effectively double your cost for a plate of spaghetti, according to Coldiretti, an agricultural organization in Italy.

The good news? Most of the pasta sold in the U.S. is already made here. But imports from Italy made up about 12% of the pasta market, according to Time magazine. If your favorite pasta is imported from Italy, it might be time to stock up before the tariffs go into effect — or find a cheaper alternative. Here are some of the largest pasta companies that make their products in the U.S. and won’t be affected by the new tariff come January.

Barilla

Believe it or not, while Barilla is an Italian company (and one of the 13 Italian pasta exporters investigated), most of its pasta sold in the U.S. is made here. Not all of it is, though, so you might need to examine the box of your favorite Barilla shape to determine whether it will be subject to tariffs.

Buitoni

Buitoni is an American brand that sells fresh pasta in the refrigerated section of the grocery store. There are various types of ravioli and tortellini, plus flat pastas. While fresh pasta might be more expensive than dried in general, if your preferred pasta’s price will be increasing, fresh may end up being cheaper.

Ronzoni

Ronzoni sells a broad array of traditional dried pastas as well as whole wheat and gluten free varieties and is widely available at grocery stores across the country. The company started in 1915 in New York City and has been making pasta there ever since, becoming one of the country’s largest pasta brands.

Creamette

Founded in 1912 in Minnesota, Creamette is still made in the U.S. using American grown wheat. Its old-fashioned green box is well known as an inexpensive brand that moms have chosen for decades, and it’s available throughout the country with the most popularity in the Midwest.

Prince

Also founded in 1912, Prince was started by three Sicilian immigrants in Boston’s famous North End. The company was named after the address of their storefront: 92 Prince Street. Today, the company sells a large assortment of dried pastas, including pastina, a tiny shape often used in soups or for small children.

Trending on Cheapism

American Beauty

American Beauty is over a century old; it was created when macaroni companies from Kansas City and Denver merged. It was a popular brand during the Great Depression and still offers shoppers a great value with homey classics like elbow noodles and mini shells.

No Yolks

It’s hard to get much more comforting than an egg noodle casserole, and No Yolks has been an American go-to in ovens since the 1970s. The slightly curly noodles come in various widths to pair with everything from Swedish meatballs to pot roast. While they’re not the kind of noodle people imagine for Italian dishes, they’re more versatile than you’d think.

Rana

Rana is a fresh pasta you’ll find in the refrigerated section of your grocery store. It was started in Italy, where its founder perfected machines for making filled pastas faster in the 1960s. The company brought its products to the U.S. in 2012, and there are multiple production facilities in Chicago to keep up with demand.

Sign up for our newsletter

Mrs. Miller’s

Located in Ohio’s Amish country, Mrs. Miller’s is still a family-owned business. It was started by Esther Miller and her husband Leon in the basement of their home. Today, their children run the business, and the bags of handmade noodles are available in specialty stores and some grocers around the country. They make a great substitute for fettuccine or linguine if your favorite brand becomes difficult to get.

More stories about tariffs:

- Trump Tariffs Threaten to Add $132 to Every Holiday Shopper’s Expenses, Study Says — Shoppers are going to shoulder most of the added cost this season.

- Carter’s Closing 150 Stores and Laying Off 300, Citing Tariffs — The chain joins a number of other businesses that have shuttered stores or gone out of business completely this year.

- How Costco Avoids Passing Tariffs on to Shoppers — Here’s how the low-cost leader with a cult following does it.