There’s little joy in combing through paperwork and receipts to figure out how much you may (or may not) owe Uncle Sam for the year. But cheer up. You could pay a lot more as a percentage of income if you lived in another country. And you could be on the hook for some of these strange, surprising, quirky, and even entertaining taxes, from owing for the cows you own or robots you use, that we found talking with tax pros and in our own research.

Related: Strange But True Tax Laws From All 50 States

1. Sweden: Baby Names

Imagine having to get approval for your newborn’s name from tax officials. In Sweden, the law says anyone “wishing to acquire or change a personal name must apply for this from the Swedish Tax Agency,” and, though some might agree to limits on legal names, it’s not clear why a baby name is a tax issue, specifically. As a result, Chayim Kessler, a CPA with Miami Beach CPA, agrees: “Sweden has one of the quirkiest tax laws.”

Related: Fun Facts to Lighten Up Tax Time

2. France: Photocopiers

France has more taxes than any other European country, says Brandon Pfaff, a tax expert who advises the publication Wealthy Living Today. “Most countries outside of the U.S. have what’s known as a value-added tax system, or VAT,” essentially a consumption tax on products, Pfaff says. But in France, “the sale of photocopiers, of all things,” brings a 3.25% tax on top of the VAT, with the money going to support the French National Library.

For more fun trivia articles, please sign up for our free newsletters.

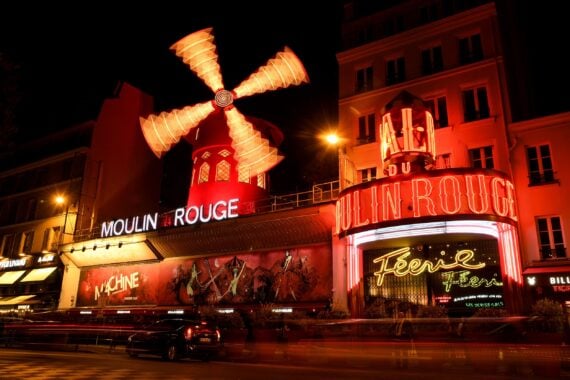

3. France: Pornography

France has also found an unusual way to fund its National Film Center. The country charges a whopping 33% tax on any pornography that’s produced, distributed, shown, or staged live in in France. (Because that’s a thing that happens in France.)

4. Denmark: Methane (from Cows)

Denmark has adopted an unusual way to take on climate change. Call it the methane tax, or the cow tax, or the flatulence tax, but the bottom line is that we’re talking taxing farmers for owning cows — because they’re among the most significant producers of methane in the world, and methane is a harmful greenhouse gas.

5. United Kingdom: Chocolate Covered Biscuits

Plain biscuits in the U.K.? A necessity, not subject to a value-added taxes. But coat them in even a little bit of chocolate, even partially, and suddenly they’re luxury items, subject to a VAT. Other sweets affected include lollipops, candy floss, and chewing gum.

Trending on Cheapism

6. Hungary: Junk Food

The battle against junk food reached new heights in Hungary with a 27% value-added tax on junk food items, which comes on top of the 25% tax it already charges on most food. Levied based on sugar, salt, and fat content, the tax appears to work: About 59% of consumers were eating less junk food four years after the law was introduced, according to the World Health Organization.

7. India: Movie Tickets

India has a tax on movie tickets, from about 18% to 28% by the price of a ticket. But those rates are actually an improvement in some states — which in the past charged as much as an 110% tax on movie tickets — and some films were declared tax free by state governments.

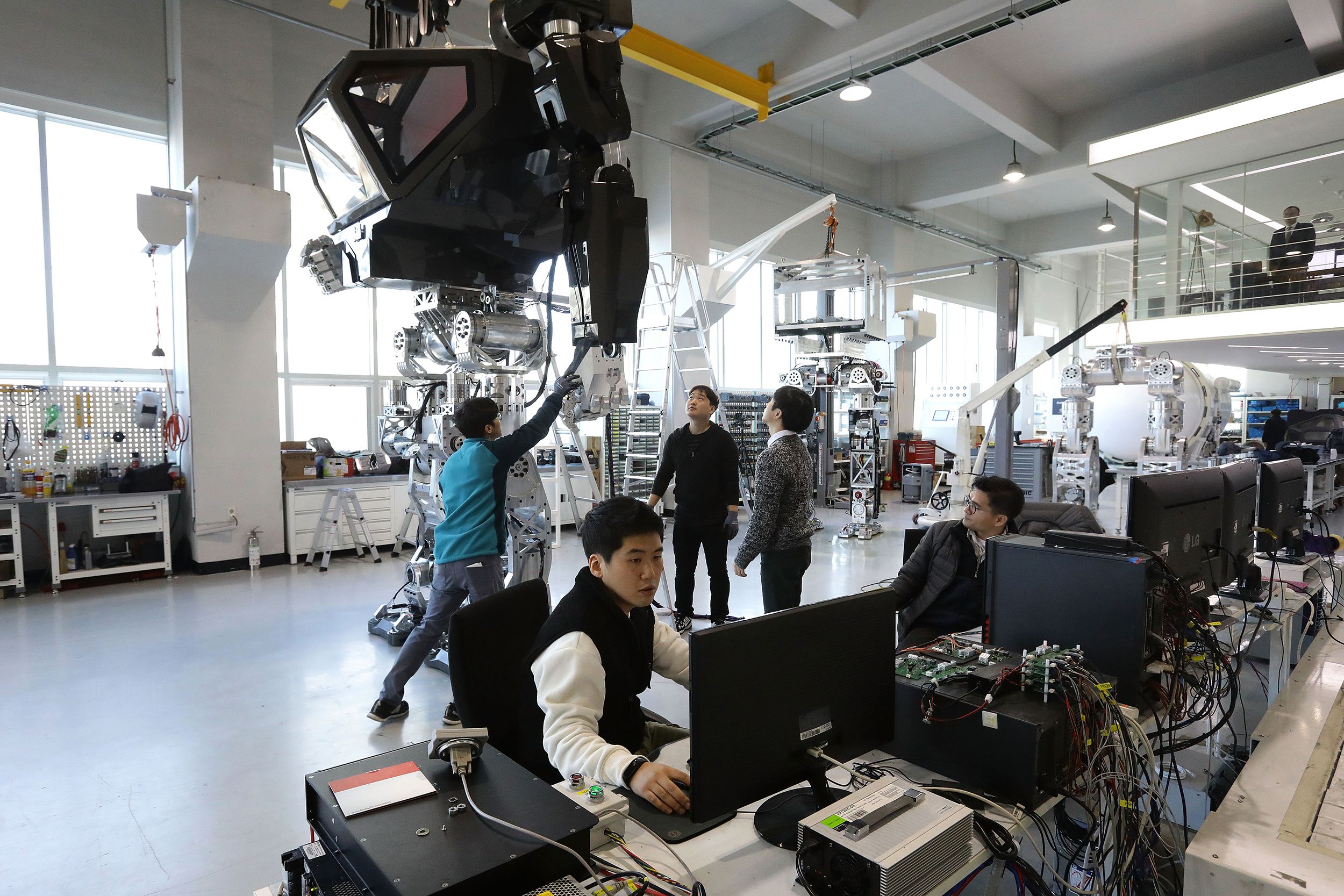

8. South Korea: Robots

The robots are coming, the robots are coming … or are already here. Whatever the case, South Korea isn’t taking chances. “South Korea introduced a robot tax to help make up for lost income tax on workers who are replaced by machines,” says Ethan Taub, CEO of financial sites Creditry and Billry. “It’s not so much of a tax as a reduction of a tax break.” To be exact, the country announced a few years ago that it would begin limiting tax incentives for investments in automating workplaces. The measure was designed to help fatten welfare funds in response to an expected increase in unemployment.

Sign up for our newsletter

9. Australia: Wine and Beer

Enjoying a few drinks in Australia can set you back a pretty penny. Let’s start with the wine tax. Those who make wine, import it to Australia, or even sell it wholesale are subject to what’s known as a wine equalization tax for 29% of the wholesale value of the wine. Beers, meanwhile, are subject to all manner of taxes. Australians overall pay 17 times more beer tax than Germany, and about 15 times more than Spain. The tax increases — tied to the inflation rate — come every six months and have gone up dozens of times.

10. Mexico: Sugary Drinks

Mexico’s way of watchdogging eating habits was a 2014 excise tax of a peso per liter of any beverage with added sugar, around a 10% tax, Taub says. (At about the same time, the government rolled out an 8% tax on non-essential foods that contain a lot of sodium, added sugars, or solid fats, including chocolates, confectionary products, puddings, ice cream, and popsicles.) Some U.S. cities have set at taxes on sugary drinks; Mexico —home of the famed full-sugar Coca-Cola, where the average person drinks 745 servings of Coke yearly — federalized it.