They say that money doesn’t buy happiness, but not having money can cause a lot of stress. In fact, financial stress is one of the biggest causes of mental health problems, especially anxiety.

If you have financial stressors in your life, you may feel like there’s nothing you can do. However, here’s a list of the top 15 financial stressors you may encounter — and how to effectively deal with them.

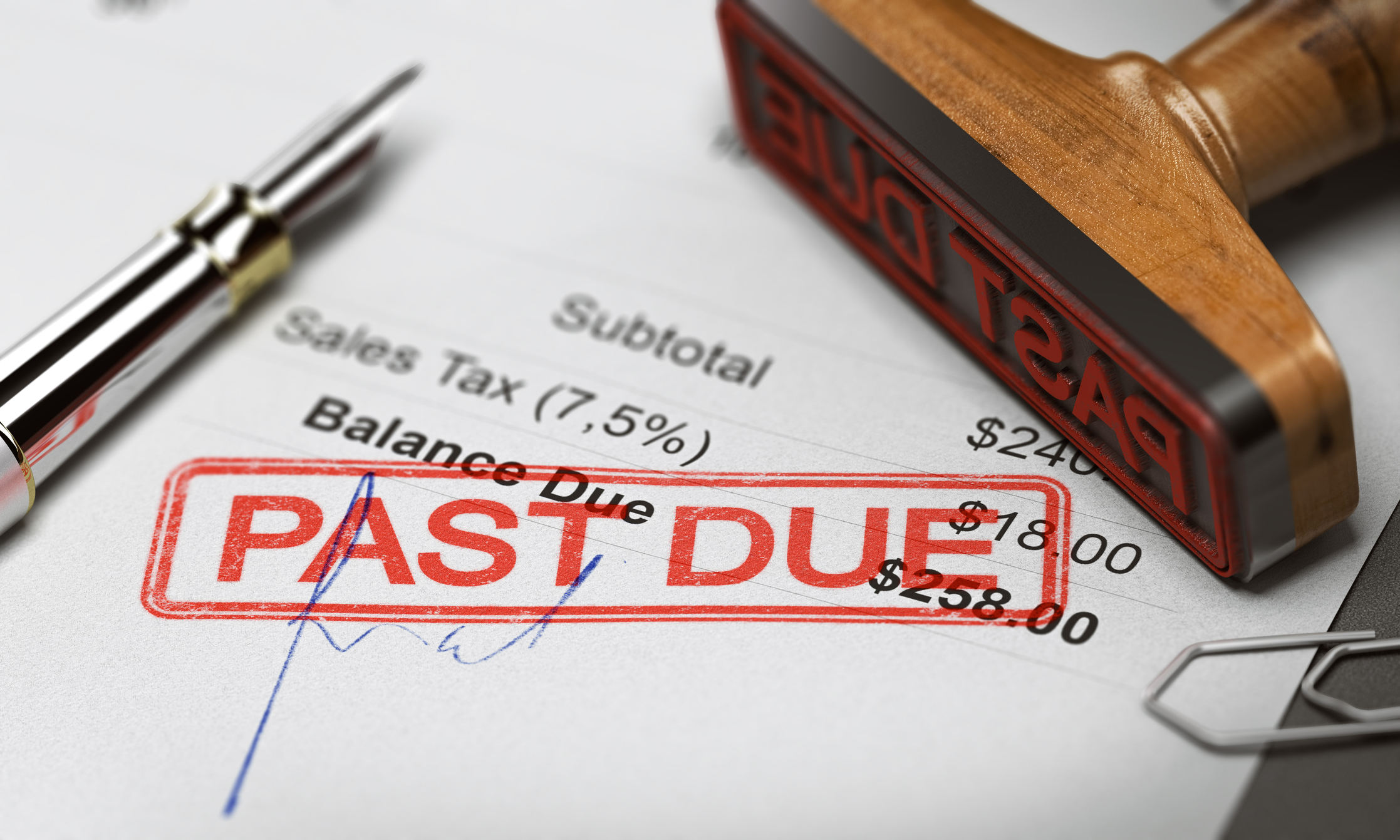

Late Fees

Paying your bills is never fun, and it’s even worse if you forget to pay them. If you’re late on a bill, you may be charged a late fee, which can cost between $20 and $40. Plus, some credit card providers may increase your APR if you make a late payment.

To avoid late fees, try signing up for automatic payments. If you have autopay, the amount due will be automatically deducted from your bank account every month. Plus, some providers may even offer a slight interest rate discount if you sign up for autopay.

Unexpected Fees

There’s nothing I hate more than being charged a fee I wasn’t expecting. Fees can come from any kind of provider and for any reason, no matter how small. For example, you may be charged a paper statement fee if you get statements and bills in the mail.

Make sure to read the fine print to understand all possible fees, whether it’s from your internet provider or gym membership. You can also try to negotiate certain fees.

Forgotten Subscriptions

Most of the time, if you have a subscription, it’s charged on a monthly basis. That makes them easier to budget for and cancel if you need to. However, some subscriptions are charged annually and are harder to spot. If you want to cancel, sometimes you can still get a refund if the subscription was recently charged. If you don’t want to cancel, see if you can switch to a monthly billing cycle so it’s easier to handle.

Higher Prices

During the height of COVID-19, prices often jumped dramatically, everywhere from the grocery store to the gas station pump. Paying more than you expected for the same item is never fun, especially if it’s something you actually need, like groceries or household products. The key is to be vigilant for price changes.

Credit Score Drops

Having your credit score suddenly drop for whatever reason can cause a lot of headaches. First, you should know that some credit score drops — like because you paid off a debt — are temporary and will bounce back. Look at your official credit report to see if there are any red flags.

Trending on Cheapism

Overdraft Fees

Overdraft fees can sting, especially if your bank insists on charging you an overdraft fee per day until your account is positive.

To avoid overdraft fees, you can link your checking account to your savings account. You can also set up your bank account to decline overdrafts. However, if that happens, then you won’t be able to pay for the transaction. Make sure you have another option if you go this route.

Unaffordable Student Loan Payments

If you’re struggling to pay back student loans, there may be other options for you. If you have federal student loans, you may be able to switch to an income-driven repayment plan that can result in much lower payments. If you have private student loans, you can try to refinance your loans with a lower interest rate, longer repayment term or both. Just know that switching to a lower monthly payment may increase the total interest paid over the life of the loan. But it’s better than missing a payment or having trouble paying your other bills.

Surprise Expenses

Even if you budget religiously, every once in a while, something will surprise you. This might be a baby shower for a coworker or a friend’s birthday bash. And unless you want to alienate those closest to you, it’s almost impossible to say no.

Try to give yourself some wiggle room every month for these surprise expenses so they’re less stressful to manage. Also, consider how many surprise expenses actually happen each year, like your company’s holiday potluck or another family wedding.

Sign up for our newsletter

Picking a Retirement Plan

Whether you’ve just started a new job or are finally opening up an IRA on your own, choosing the right investment plan can be tricky. You may not know which one to sign up for or what types of investments to choose. This indecision could cost you a lot of money, since the power of compound interest shows that it’s best to start investing as soon as possible.

Saving for Your Child’s College Education

Every parent wants to give their child the best that life has to offer and that often means saving for their college education. But with future tuition prices hovering close to six figures that seems nearly impossible.

Instead of worrying about your child’s college education, encourage them to be good, well-rounded students. Then, when the time is right, help them apply for scholarships.

Paying for Home Repairs and Maintenance

Most people think of their home as an investment, but it can also be a huge money sink. New AC? That’s $10,000. Need to replace the roof? That’s $15,000. No matter how well-built your home is, you will always run into potential problems. You should always save for home repairs and maintenance, even if your home is brand new.

Being a Victim of Identity Theft

Dealing with identity theft is immensely stressful, especially if the perpetrator was a member of your own family or someone else you know. Even if you don’t end up being financially responsible, it can take weeks or even months to resolve identity theft.

Want to prevent identity theft? You can freeze your credit, which ensures that no one can open a new loan, credit card or line of credit in your name. Even if someone has your information, they won’t be able to hurt you financially in this case.

Handling Your Parent’s Finances

If you have elderly parents, taking care of their health can be a huge burden. And it’s the same if you have to manage their finances. Elderly people are susceptible to identify theft and scams. If possible, see if you can get power of attorney over their finances. This will help you stay on top of any potential issues, like them withdrawing their entire checking account to send to a foreign prince.

Getting Billed for Out-of-Network Medical Expenses

It’s a common scenario: You visit a doctor or hospital thinking that they’re in your insurance network. Then, you get a huge bill because one of the providers was actually out-of-network. When this happens, you should try to dispute the bill with your insurance company, especially if it was for an emergency.

Sometimes you can contact the provider’s billing department and ask them if you can pay in cash — the cash price may be lower than what you’d pay if it went through your insurance.

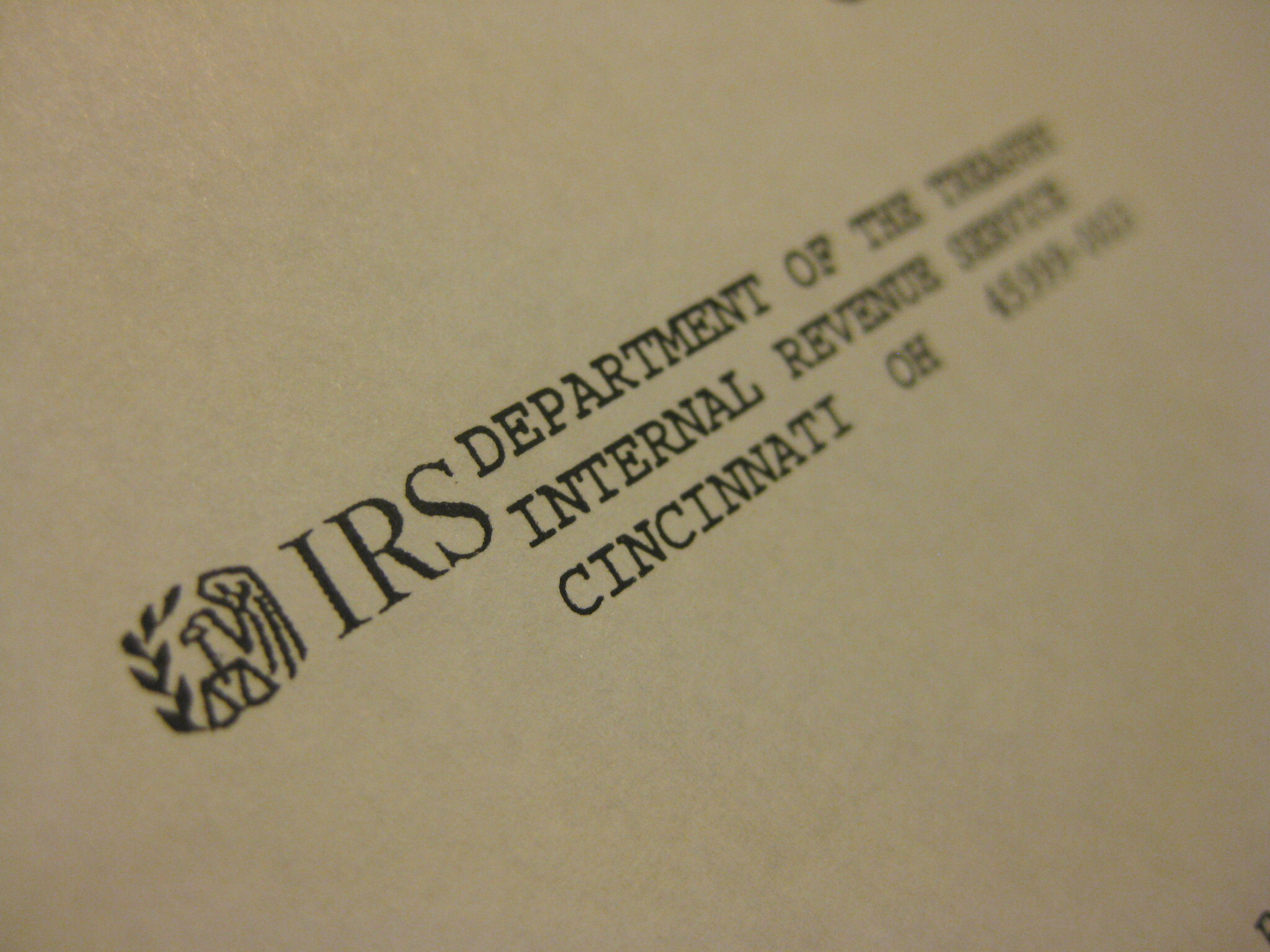

Owing Back Taxes

Tax time is tough for everyone, but it’s worse if you owe taxes. If you do have a hefty tax bill, you may be able to break up the amount into manageable payments. However, you should also figure out why you owe so much. Do you need to change your withholding for next year or save more for estimated quarterly taxes? Did you have a huge windfall that likely won’t happen again?

For more smart personal-finance tips, please sign up for our free newsletters.