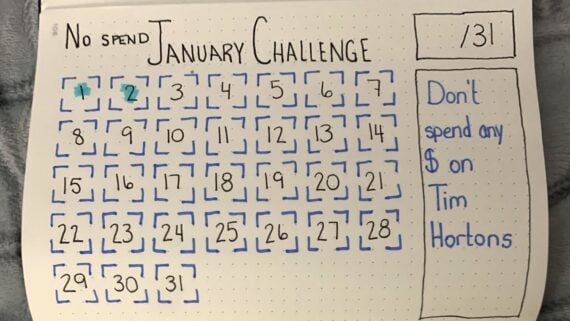

If you made a New Year’s resolution to spend less — and then spent $18 on coffee and a breakfast sandwich a couple of days in — you’re not alone. That’s exactly why “no-spend days,” weeks, and even months are gaining traction right now, and if saving money is high on your priority list, this tactic is worth exploring. The idea is simple: Pick a period of time where you don’t spend money beyond true necessities. In practice, it’s a lot more flexible than it sounds, and that flexibility is why it works.

What Is a ‘No-Spend’ Day?

Despite the name, most people doing no-spend challenges aren’t trying to spend literally zero dollars. Across Reddit threads, the most common rules look like this:

- Bills still get paid.

- Groceries are allowed (ideally planned, not impulse snacks).

- Gas and prescriptions are fine.

- Everything else pauses.

As one Redditor put it bluntly: “I don’t buy anything. That’s the point.” Others admit it’s easier if they don’t leave the house (we’ve all seen the TikTok trend of the cash register sound the second you step out the door), or they plan ahead so they don’t have to.

What almost everyone agrees on: No-spend days are about cutting impulse spending, not pretending rent and utilities don’t exist.

Why It Works

No-spend days force you to confront where your money actually leaks out. For most people, it’s not big purchases. It’s coffee runs, lunch out, delivery fees, and “small” buys that add up fast.

One Redditor said cutting weekday spending alone made a noticeable difference. Another shared that delaying purchases (even basics like shampoo until everything was fully used) had a “crazy positive impact” on their savings.

TikTok user @financielle offers tips for a successful no-spend month, including:

- Defining what you’re “allowed” to spend money on.

- Planning on temptations. If you see something you want to buy that doesn’t fit in the rules, revisit it after your no-spend month — by then, you’ll probably decide it was just an impulse.

- Swapping purchases for at-home alternatives.

- Creating a purpose for the money you’re saving to have a goal to work toward (and tracking your progress).

Everyone’s Rules Are Different

Some people do two no-spend days a week. Others swear by entire no-spend months. A few take it to the extreme and avoid discretionary spending for several months or even a year.

Common variations include:

- Groceries allowed, but no alcohol.

- Eating out banned, but social plans still okay.

- Spending only on “unfun” items (toilet paper yes, candles no).

- Using up pantry and freezer food before buying more.

One Redditor summed it up best: “I’m trying to be frugal and efficient, not cheap.”

No-spend days work because they slow down automatic spending. They create just enough friction to make you ask: “Do I actually need this, or do I just want it right now?” For many people, that pause is enough to stop a purchase entirely. For others, it makes spending feel more deliberate instead of reactive. You’ll be surprised how much you don’t need to spend to live your life.

More From Cheapism

- Reverse Budgeting: How the ‘Pay-Yourself-First’ Approach Can Boost Your Savings — Reverse budgeting flips that habit on its head in the simplest way possible: You pay yourself first.

- How Kakeibo, a 120-Year-Old Japanese Budgeting Technique, Is Saving People Money — Discover more about the Kakeibo method, a budgeting style that resembles journaling.

- 11 Budgeting Mistakes That Could Cost You — Avoid these mistakes so that you actually can cut back on spending.